Guest post by Drone Industry Insights —

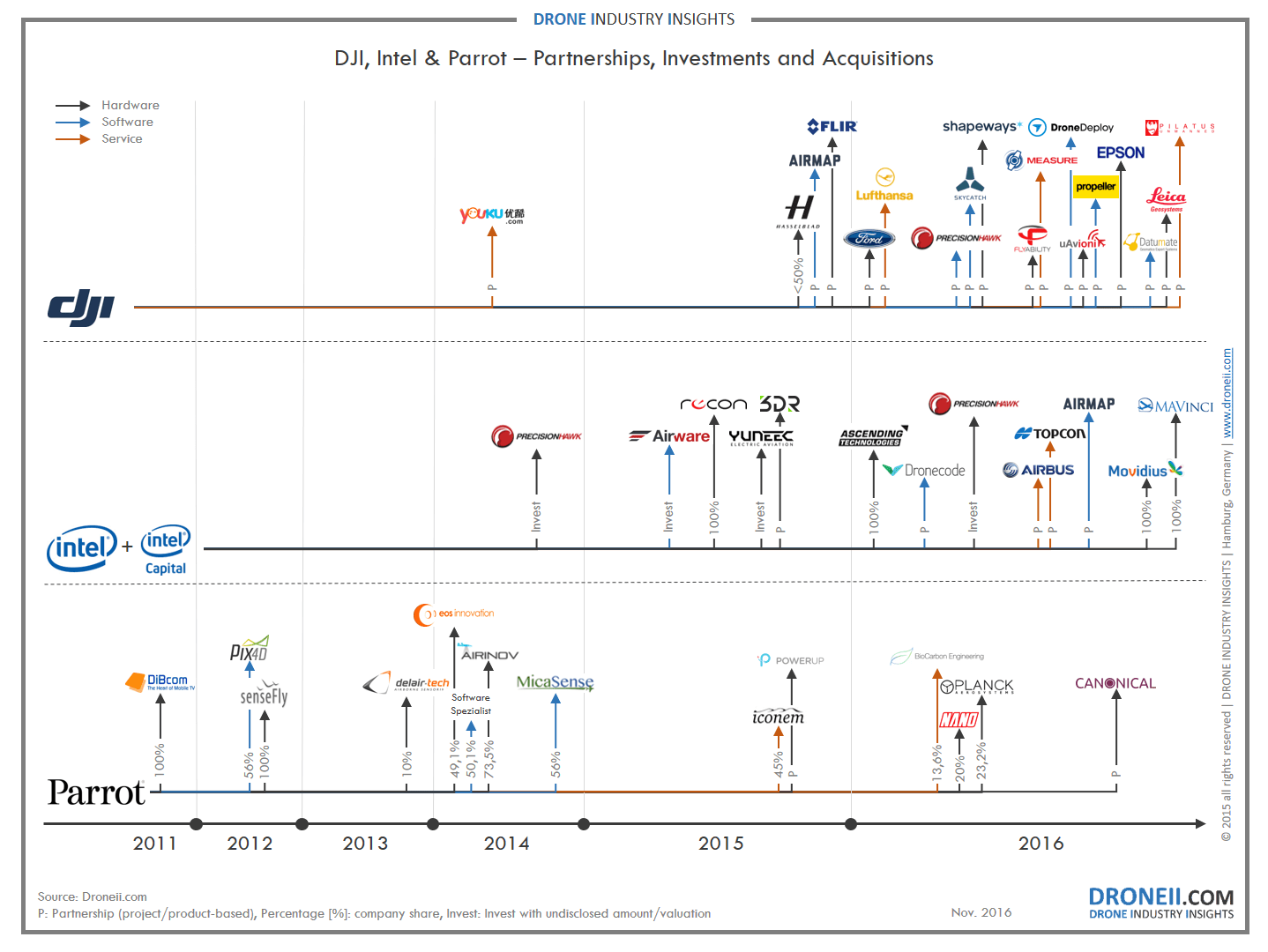

The drone market today can be described as a melting pot of different technologies, where combinations of hard- and software components and service features are provided to the end user. In order to create sustainable success in this extremely fast moving market it is essential to maintain strategic partnerships or invest in a solid UAV portfolio. This is nothing new and as we showed in our recent publication this is a process that started quite a while ago, long before anyone thought about drones to be the next big thing.

However, lately a few players have been extremely busy with engaging in new partnerships, looking for investment opportunities and acquisitions.

Currently, the commercial UAV market consists of three dominant players, namely DJI, Parrot SA and the Intel Corporation.

Parrot started creating professional solutions at a very early stage. The acquisition of Software manufacturer Pix4D (2012) and MicaSense (2014) were great strategic moves and paved the way to highly advanced end-to-end solutions. Although profit margins in the commercial UAV market were very small at this time, Parrot did invest heavily into their new strategy. Building a new market segment has never been easy (or cheap) and the low-cost competitors from Asia also apply a lot of pressure causing market deficits especially in the hobby/prosumer sector. Despite, the share of the drone sector within the Parrot Group increased from 38% (Q1 2016) to 54% (Q2 2016) due to this strategic move.

Whereas Parrot started three years earlier, Intel Capital started in 2014 to invest into the drone industry. Now, Intel Corp. chooses a pro-active approach and moves into the market by acquiring the missing pieces of the puzzle around their high-performance chip-sets. The Intel RealSense platform combines hardware and software in a way that enables cameras to process and understand images, and eventually providing “computer vision” to flying drones. Before acquiring the German drone manufacturer Ascending Technologies earlier this year, the two companies had already engaged in a close partnership to improve UAV sense and avoid systems. Intel’s biggest and certainly most game-changing move was the acquisition of the mobile vision processor company Movidius. This acquisition paves Intel’s way towards autonomous systems – not only for unmanned aerial vehicles.

Other chip manufacturers such as Qualcomm and Nvidia have recently copied Intel’s strategy, as they see the immense opportunities in becoming technology suppliers for the emerging drone industry.

The third key player and dominant market leader DJI also started a number of new partnerships this year. While Intel and Parrot grew their drone business through acquisitions, DJI now uses partners to expand their business portfolio (e.g. the infrared camera maker FLIR, surveying expert Leica Geosystems and micro ADS-B transponder manufacturer uAviniox). For their position this strategy makes a lot of sense since DJI has everything it needs to bring drones up in the air and as such, does not have to acquire the technology. Partnering can be an extremely quick way to grow a company, particularly in times of rapid change. Without implementing difficult and time-consuming internal changes DJI can expand the knowledge of different industry sectors, boost innovation and increase their market share.

Initially partnerships were heavy on hardware but the demand to deliver high-quality end-to-end products more quickly and at lower costs has become a fundamental part of the entire UAV industry.

If you want to learn more about the investments, acquisitions and partnerships in the drone industry please contact us.

In case you have missed one of our latest publications:

TOP20 Drone Company Ranking Q3 2016

Drones in Surveying – a Value Chain Analysis for the Construction Industry

Frank Schroth is editor in chief of DroneLife, the authoritative source for news and analysis on the drone industry: it’s people, products, trends, and events.

Email Frank

TWITTER:@fschroth

Drone market strategies – partnerships and acquisitions of three dominant players

Guest post by Drone Industry Insights —

The drone market today can be described as a melting pot of different technologies, where combinations of hard- and software components and service features are provided to the end user. In order to create sustainable success in this extremely fast moving market it is essential to maintain strategic partnerships or invest in a solid UAV portfolio. This is nothing new and as we showed in our recent publication this is a process that started quite a while ago, long before anyone thought about drones to be the next big thing.

However, lately a few players have been extremely busy with engaging in new partnerships, looking for investment opportunities and acquisitions.

Currently, the commercial UAV market consists of three dominant players, namely DJI, Parrot SA and the Intel Corporation.

Parrot started creating professional solutions at a very early stage. The acquisition of Software manufacturer Pix4D (2012) and MicaSense (2014) were great strategic moves and paved the way to highly advanced end-to-end solutions. Although profit margins in the commercial UAV market were very small at this time, Parrot did invest heavily into their new strategy. Building a new market segment has never been easy (or cheap) and the low-cost competitors from Asia also apply a lot of pressure causing market deficits especially in the hobby/prosumer sector. Despite, the share of the drone sector within the Parrot Group increased from 38% (Q1 2016) to 54% (Q2 2016) due to this strategic move.

Whereas Parrot started three years earlier, Intel Capital started in 2014 to invest into the drone industry. Now, Intel Corp. chooses a pro-active approach and moves into the market by acquiring the missing pieces of the puzzle around their high-performance chip-sets. The Intel RealSense platform combines hardware and software in a way that enables cameras to process and understand images, and eventually providing “computer vision” to flying drones. Before acquiring the German drone manufacturer Ascending Technologies earlier this year, the two companies had already engaged in a close partnership to improve UAV sense and avoid systems. Intel’s biggest and certainly most game-changing move was the acquisition of the mobile vision processor company Movidius. This acquisition paves Intel’s way towards autonomous systems – not only for unmanned aerial vehicles.

Other chip manufacturers such as Qualcomm and Nvidia have recently copied Intel’s strategy, as they see the immense opportunities in becoming technology suppliers for the emerging drone industry.

The third key player and dominant market leader DJI also started a number of new partnerships this year. While Intel and Parrot grew their drone business through acquisitions, DJI now uses partners to expand their business portfolio (e.g. the infrared camera maker FLIR, surveying expert Leica Geosystems and micro ADS-B transponder manufacturer uAviniox). For their position this strategy makes a lot of sense since DJI has everything it needs to bring drones up in the air and as such, does not have to acquire the technology. Partnering can be an extremely quick way to grow a company, particularly in times of rapid change. Without implementing difficult and time-consuming internal changes DJI can expand the knowledge of different industry sectors, boost innovation and increase their market share.

Initially partnerships were heavy on hardware but the demand to deliver high-quality end-to-end products more quickly and at lower costs has become a fundamental part of the entire UAV industry.

If you want to learn more about the investments, acquisitions and partnerships in the drone industry please contact us.

In case you have missed one of our latest publications:

TOP20 Drone Company Ranking Q3 2016

Drones in Surveying – a Value Chain Analysis for the Construction Industry

Frank Schroth is editor in chief of DroneLife, the authoritative source for news and analysis on the drone industry: it’s people, products, trends, and events.

Email Frank

TWITTER:@fschroth

See Also