Dronifi’s software-as-a-service for drone-based business service providers offers unique features, but can it compete with its well-funded rivals?

QuickTake

THE FACTS:

With U.S. Part 107 UAS pilot certifications growing (now at 23,000), the commercial drone industry is rapidly changing from a product-focused industry to a service-based one. Dronifi, a four-year-old California startup, was one of the first companies to identify and exploit this change. They’ve developed a suite of online drone data software applications for drone-based business service providers.

Dronifi started as FarmSolutions and as a software-as-a-service (SaaS) solution for the agriculture industry. But they have quietly expanded their offering to cover turf management, mining, and construction. This video gives a pretty good overview of their service platform offering.

WHAT’S COOL AND WHAT’S NOT:

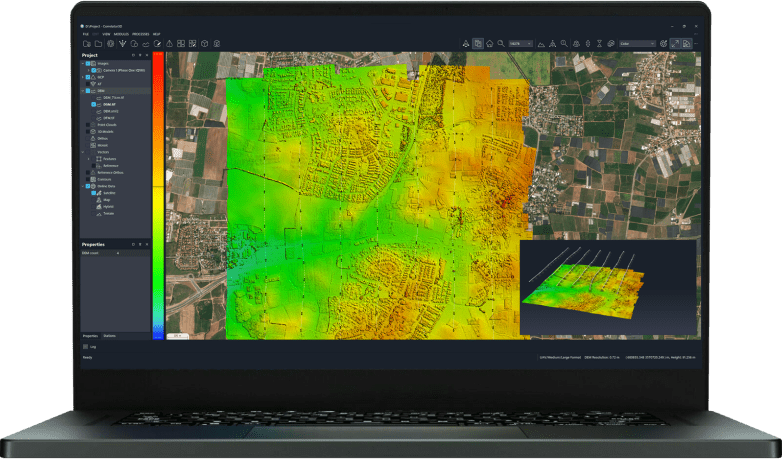

Dronifi’s expanded SaaS suite includes tools to process, analyze, store, and deliver data from drones. It also has integrated tools for sales and marketing, custom reports, and offers service providers the ability to create customizable portals so commercial drone pilots can more easily attract business from a variety of vertical markets. This has the potential of creating loyal subscribers and frees pilots to concentrate on what they do best–flying and taking images.

A turf use case provides a good example of how this works. A golf course superintendent is concerned about encroachment of Bermuda grass on areas of the course. He contacts a drone-based business service provider and asks for a quote to take aerial photos so he can assess the problem. The drone pilot provides a marketing plan, furnished by Dronifi, but under his or her own brand, that explains how the mission will be flown and what deliverables the superintendent can expect to receive. Data from the flight is then sent to Dronifi, where it is processed and analyzed. Once this procedure is finished, the pilot receives a report (once again branded under the pilot’s logo) which not only shows course photos but also identifies the specific turf areas affected by Bermuda grass. The pilot then passes this information to the client, or golf course superintendent.

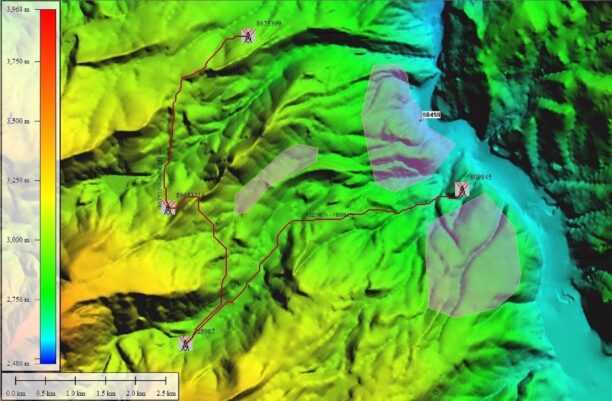

Dronifi’s agricultural and turf solution (which is FarmSolutions) is feature-rich and mature. It allows users to combine satellite data with high-resolution drone images and provides support for thermal, normalized difference vegetation index (NDVI), and other crop vigor imagery. The image analysis tools automatically detect areas of interest and show you changes over time. This is where it gets interesting, because those tools can be applied to most any industry. So whether it’s a spot in the farmer’s field or a spot on a roof, users can see if the problem is getting bigger or smaller.

If you need to process aerial data in real-time, Dronifi may not be the only solution for you. In some instances, you may need real-time previews or on-site local processing so you can view, and correct mission planning coverage (if necessary) while in flight or on site. No one wants to find that a mission needs to be reflown days later.

THE COMPETITION:

Dronifi’s business platform is not a one-size-fits-all solution, and there are no shortage of competitors. DataMapper, DroneDeploy, Maps Made Easy, Pix4D Hybrid, and Skycatch Commander are just some of the startup companies that compete with and may be complementary to Dronifi at some level. Some drone-based service providers may prefer to use competitive solutions, depending on the downstream use of the data. Some may want to use Esri Drone2Map if they want direct integration with ArcGIS, and some may want to use Autodesk Forge if they want cross-platform integration with other Autodesk products. The market should be large enough to support multiple vendors, but it’s difficult to imagine that all of the companies listed here will be around in three years.

BOTTOM LINE:

Dronifi, with its drone data services SaaS platform, has a compelling business model that should inspire loyalty and generate increased revenue for drone-based business service providers. Dronifi’s challenge will be to ramp up their customer base while avoiding spreading development resources too thin. As a bootstrapped four-year-old company, it’s very possible they will need additional investment to maintain positive growth.

Colin Snow is CEO and Founder of Skylogic Research, LLC (aka Drone Analyst®), a research, content, and advisory services firm for the commercial drone industry. Colin is a 25-year technology industry veteran with a background in market research, enterprise software, electronics, digital imaging, and mobility.

Colin Snow is CEO and Founder of Skylogic Research, LLC (aka Drone Analyst®), a research, content, and advisory services firm for the commercial drone industry. Colin is a 25-year technology industry veteran with a background in market research, enterprise software, electronics, digital imaging, and mobility.

Frank Schroth is editor in chief of DroneLife, the authoritative source for news and analysis on the drone industry: it’s people, products, trends, and events.

Email Frank

TWITTER:@fschroth

[…] post Can Dronifi Succeed Where Established Online Drone Data Services Haven’t? appeared first on […]