Innovations will flourish on drones that target the prosumer market for a long time.

QuickTake

THE FACTS:

In the 1980 book, The Third Wave, futurologist Alvin Toffler coined the term “prosumer” when he predicted that the role of producers and consumers would begin to blur and merge. Today, the term is well accepted as a descriptor for camcorders, digital cameras, and similar goods. Prosumers are enthusiasts who buy products (almost always technical) that fall between professional and consumer-grade standards in quality, complexity, or functionality. Prosumer also commonly refers to those products.

Recently, a well-respected analyst mentioned that his firm thought that prosumer drones would disappear from the market in the near future. At the time, I thought this quite bizarre—because our research says exactly the opposite. I’m still shaking my head.

Earlier this year, we released “Drones in the Channel: 2016 Market Report,” a research study examining drone sales and distribution channels in North America. It’s the first in-depth study of drone sales that reveals the buying patterns of both consumers and professionals. The report has a detailed analysis that calls into question the commonly held and often undefined prosumer term. I’ll summarize the salient points of that research and offer insights into why I think the prosumer drone is here to stay.

WHAT BUYERS SAY:

We approached our research without preconceptions about commonly held terms used to describe drone segments or tiers, such as “consumer,” “prosumer,” and “professional.” Since all drones sold—no matter what the price point—are purchased by a consumer, we believe the best way to sort out these terms was by understanding the purchaser’s intended use. Our findings are summarized in the chart image in Table 1.

Table 1 – Drone Price / Market Segments

| Descriptor | Price Range | Hobby

Use |

Non-Hobby Use |

| Consumer | Less than $500 | 73% | 27% |

| $500 – $999 | 65% | 35% | |

| Prosumer | $1,000 – $1,999 | 39% | 61% |

| Professional | $2,000 – $3,999 | 11% | 89% |

| $4,000 – $7,499 | 3% | 97% | |

| $7,500 – $34,999 | 0% | 100% | |

| $35,000 – $99,999 | 0% | 100% | |

| More than $100,000 | 0% | 100% |

Source: Skylogic Research

As you can see from the chart, “prosumer” is—as we have defined it—a very narrow category, and the majority of prosumer buyers purchase their drone with either civil / commercial or public / governmental use in mind. Overall, the data we collected from the quantitative portion of this study finds 61 percent of respondents said they purchased a drone in the $1,000 to $2,000 price range explicitly for professional use.

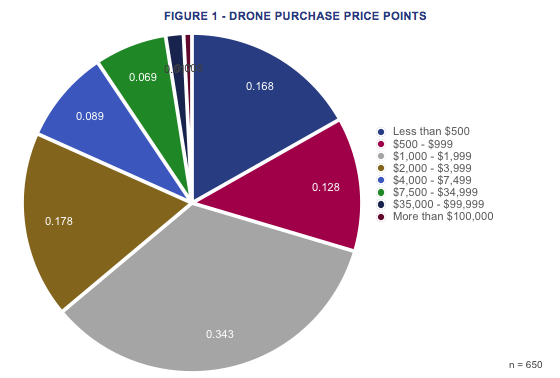

What is even more interesting is what respondents said they paid for their most recent drone. Figure 1 shows those results. More than half of buyers purchase drones costing between $1,000 and $4,000. We calculate that the mid-price range is $1,400. Readers should note that $1,400 is the approximate cost of the popular DJI Phantom 4, Yuneec Typhoon H, and the just released DJI Mavic Pro, and together these brands account for approximately 72 percent of all drones purchased in the $1,000 – $2,000 price range.

FIGURE 1 – DRONE PURCHASE PRICE POINTS

Click on the image for a larger view

WHAT OTHER ANALYSTS MISS:

- The Film/Photo/Video market is—and will probably always be—the largest commercial drone market segment. Our survey data going back to 2014 and even our most recent report confirms this. Most analyst forecasts—even at the large firms like Gartner, Teal, and PwC—don’t account for the full potential of drones in that segment, nor do they incorporate any first-hand knowledge from those who’ve already operated in that segment. The photographic, film, and real estate industries have known for years that small drones are a more viable and less costly substitute for manned aerial photography. It’s also no secret that this market is already established and towers above all others both in revenue and number of existing service providers (see what I wrote about that here).

- All the major mission planning and mapping applications like DroneDeploy, PrecisionHawk’s DataMapper, and Skycatch Commander (and dozens more) now run with the DJI SDK. Most of these started off with applications dedicated to their own drone but soon found that most professionals want to use the simpler and more reliable DJI prosumer drones.

- The prosumer drone category is the only place where sales volumes and margins are strong enough for manufacturers to recoup R&D investment. As I wrote about in Sense and Avoid for Drones is No Easy Feat, you can see this trend now with obstacle avoidance technology.

BOTTOM LINE:

Prosumer drones have already created new sources of demand for aerial imaging, and this will continue in earnest. As with land-based photography and video services, the financial and technical barriers to entry are low, making it easy for businesses to begin offering drone-based services. Now that the regulatory hurdle is low with Part 107, more new entrants will create demand for this segment.

Colin Snow is CEO and Founder of Skylogic Research, LLC (aka Drone Analyst®), a research, content, and advisory services firm for the commercial drone industry. Colin is a 25-year technology industry veteran with a background in market research, enterprise software, electronics, digital imaging, and mobility.

Colin Snow is CEO and Founder of Skylogic Research, LLC (aka Drone Analyst®), a research, content, and advisory services firm for the commercial drone industry. Colin is a 25-year technology industry veteran with a background in market research, enterprise software, electronics, digital imaging, and mobility.

Alan is serial entrepreneur, active angel investor, and a drone enthusiast. He co-founded DRONELIFE.com to address the emerging commercial market for drones and drone technology. Prior to DRONELIFE.com, Alan co-founded Where.com, ThinkingScreen Media, and Nurse.com. Recently, Alan has co-founded Crowditz.com, a leader in Equity Crowdfunding Data, Analytics, and Insights. Alan can be reached at alan(at)dronelife.com

[…] post The Prosumer Drone Will Never Die appeared first on […]