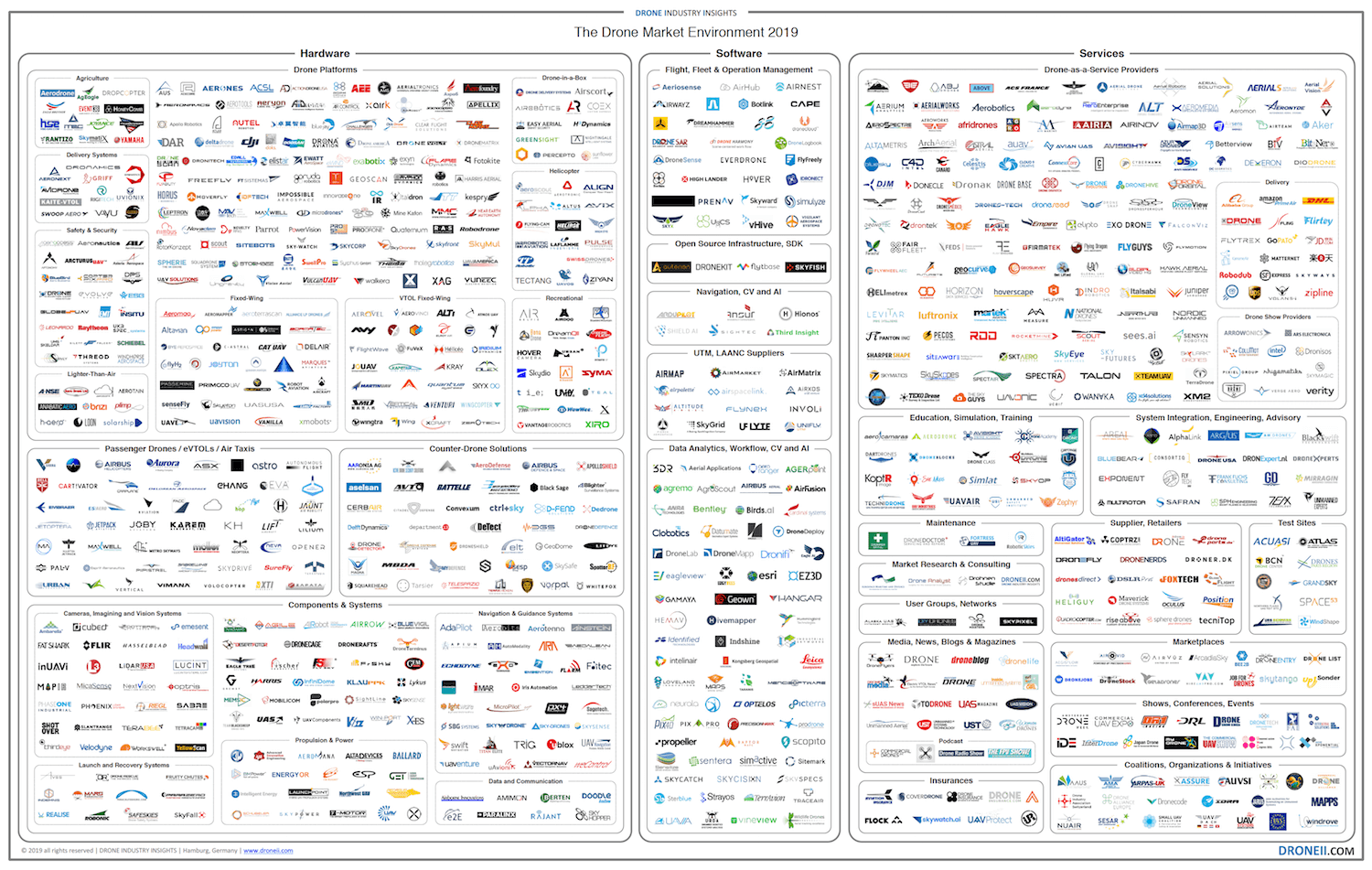

Industry Update: The Drone Market Environment Map 2019

The newly released DRONEII’s Drone Market Environment Map 2019 gives a snapshot of the most relevant players on the global commercial drone market. Here are some key drone industry updates to bear in mind for this year:

![]() Guest Post: This article published with permission from our friends at DroneII, Drone Industry Insights. Article authored by Kay Wackwitz.

Guest Post: This article published with permission from our friends at DroneII, Drone Industry Insights. Article authored by Kay Wackwitz.

Hardware: eVTOLs and Counter-Drone Solutions Steal the Spotlight

Within the hardware segment passenger drones (eVTOLs/air taxis) and counter-drone companies have been the most talked about. As of this year there are nearly 200 concepts within the passenger drones field and an increasing number of conferences are featuring urban aerial mobility (UAM) discussions and even the first demos. Meanwhile, recent incidents at Gatwick, Heathrow, Frankfurt, Dubai, Singapore and many other airports have sparked increased interest in counter-drone technology. Since the end of 2018, the media has put the spotlight on counter-drone technology. Unsurprisingly, in the Drone Industry Barometer 2019 counter-drone companies were the most optimistic about business in the coming year.

As for platform manufacturers, the changes in the map largely depict a consolidation story – larger companies bought out smaller ones with potential and other companies ran out of time or money. For example, AeroVironment acquired Pulse Aerospace ($25.7m) and Flir Systems acquired Aeryon Labs ($200m). Another notable trend is specialisation of hardware products. Nowadays, hardware manufacturers offer increasingly niche products like delivery systems, drone-in-a-box solutions, and more.

Meanwhile, components & systems manufacturers are (as the Drone Industry Barometer noted) spending more and more money on marketing & sales. This means that either 1) the industry has matured enough that they now have polished products ready for mass sales; or 2) they are simply struggling to sell their products. There can, of course, be no discussion of drone hardware without the mention of market leader DJI. Since DJI have not announced any new recreational products this year, we can now assume that they will increase their focus on commercial products.

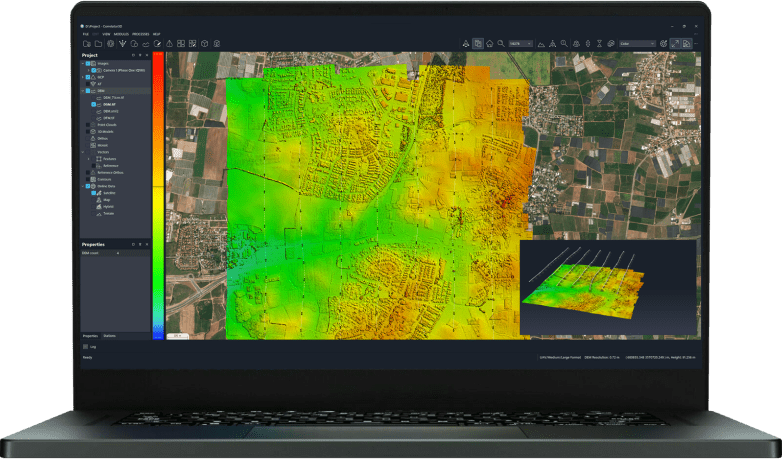

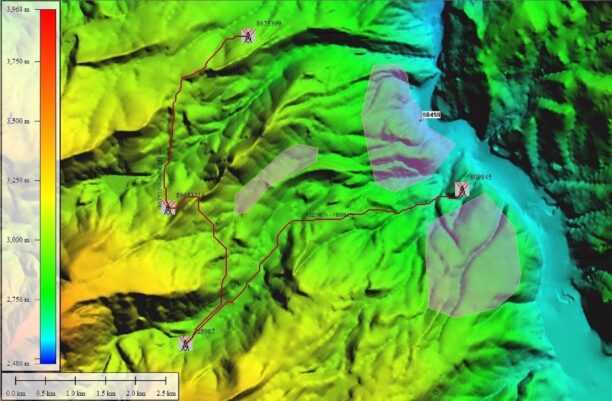

Software: The Race to E2E

Software is thefastest growing segment of the drone market. To this day, people still underestimate the sheer amount of data that drones collect and the tools that are needed to manage that data. Software businesses have emerged to fill that demand and due to the virtual nature of their business they have been able to scale quicker more easily and to access new markets with few barriers. Meanwhile, not only are software businesses scaling up, but they are expanding their portfolios. Today computer vision (CV) and artificial intelligence (AI) are consistently being used to streamline drone data analytics.

Thanks to software innovation in the drone industry, it is possible that task-specific software solutions will evolve into all-in-one solutions. This would mean that in a few years there would be no more software sub-segments left as companies aim to offer operation management systems (i.e. ERP systems) for drones.

The investments into software reflect optimism about the fastest growing drone market segment. For example, late last year in just their Seed Round Swiss company Auterion was able to raise $10 million. Meanwhile, the Chinese Clobotics raised $11 million in a Series A funding round, and DFS bought into Unifly for $13 million.

Services: In Diversity There’s Strength

The drone services market is the largest segment in the commercial drone industry. Much like hardware companies a few years ago, service companies continue to professionalise. While at first many drone service companies sought to target multiple applications and verticals at once, they are now narrowing down their focus to produce more niche solutions.

Marketplaces continue to expand on the commercial drone market. Currently there are three kinds of marketplaces: those for pilots, data (video and pictures), and those for hardware. These matchmaking platforms have great potential to become drone operators. For example, some companies transformed from marketplaces to drone as a service providers which work based on a freelance pilot network. Another service sub-segment, insurance, is growing steadily. This is largely because an increasing number of drone regulations across the globe now mandate that all commercial drones be insured.

Finally, what we’ve seen, not just in the services segment but across the board, is a major improvement in the quality of marketing and branding of drone companies. This reflects industry maturity. It is also not a surprise as we’ve already learned that companies are spending increasing amounts on sales & marketing, and that drone companies are increasingly hiring for sales and marketing professionals.

The best companies in the service industry, just like in the hardware industry, are now being snapped up by larger corporations as part of the market consolidation process (e.g. ICR Integrity acquiring Sky-Futures Partners). Meanwhile, rapidly growing drone service companies are also expanding into new markets and as a result of that buying up smaller players (e.g. Japanese Terra Drone acquiring a majority stake in Skeye to set up their European HQ).

What Now?

Given these changes, what are the key trends to watch out for over the next year? A lot remains to be seen, but the following trends will dominate the drone market:

- Companies will keep pulling services in-house to keep control over critical data which they either need immediately or want to keep private.

- Bigger deals, but fewer deals. Angel investments won’t stop, but we do know that they’re in decline. Instead we’re seeing an increase in larger VC deals – already this year the healthcare delivery leader, Zipline, secured a $190 million investment.

- Big players will keep opening regulatory doors for smaller ones. Thanks to market consolidation and accumulated experience larger players on the drone market will increasingly be able to get the necessary waivers and exemptions and to experiment with more complex missions therefore opening doors for those around them to follow in their footsteps.

As the drone market continues to consolidate and major players broaden their portfolios, we notice that they are already beginning to venture across segment lines. This means that for those larger companies, the hardware/software/services segregation will no longer apply in the future. Instead, we expect to see them competing to deliver end-to-end solutions to their clients. This is great news for the future of the drone market as E2E solutions will be the ultimate proof of concept for drone technology, taking away any doubts about its relevance.

Named one of the most influential people in the commercial drone industry by the Commercial UAV Expo, Kay established DRONEII as the leading drone market research consultancy after working for Lufthansa. As well as personally consulting on projects and producing reports, he frequently speaks at conferences, seminars and expos.

Miriam McNabb is the Editor-in-Chief of DRONELIFE and CEO of JobForDrones, a professional drone services marketplace, and a fascinated observer of the emerging drone industry and the regulatory environment for drones. Miriam has penned over 3,000 articles focused on the commercial drone space and is an international speaker and recognized figure in the industry. Miriam has a degree from the University of Chicago and over 20 years of experience in high tech sales and marketing for new technologies.

For drone industry consulting or writing, Email Miriam.

TWITTER:@spaldingbarker

Subscribe to DroneLife here.

[…] Industry Insights has published an update to its annual Drone Market Environment Map. […]