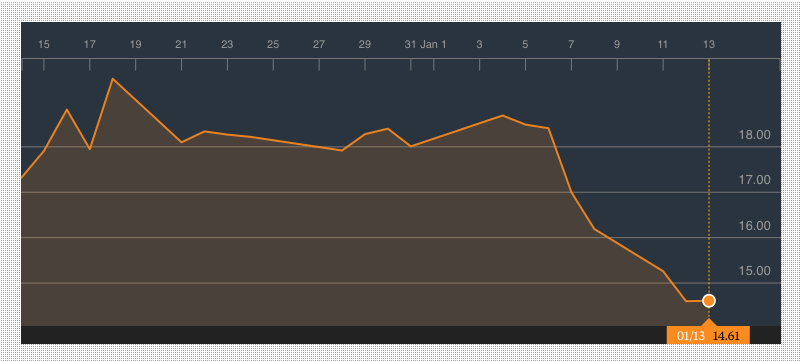

The stock market has been tough on everyone but it has been especially hard on GoPro, yesterday in particular. The stock plunged over 20% on announcement of a 7% workforce reduction.

And this morning Shareholder Rights Law Firm Johnson & Weaver, LLP announced it is “investigating if GoPro, Inc. (GPRO) committed securities violations. The investigation focuses on whether GoPro and its officers violated securities laws by issuing misleading information to investors related to the Company’s November 20, 2014 secondary public offering (SPO). . . Johnson & Weaver’s investigation seeks to determine if the offering documents filed with the SEC for the secondary offering contained untrue statements regarding GoPro’s business and prospects.” (You can view their press release here.)

GoPro is a consumer electronics company that pioneered the design and development of mountable and wearable cameras and related accessories for outdoor enthusiasts.

The stock has been on a roller coaster since last December. FBR’s Daniel Ives speculated that Apple might acquire GoPro. This sent GoPro up for a couple of days. Then Citi analyst Jeremy David said he thought the valuation was high and downgraded GoPro from Buy to Neutral.

The rapid emergence of camera equipped drones with increasingly sophisticated capabilities such as “follow me” functionality coupled with affordable prices has offered significant competition to GoPro’s unique selling proposition.

GoPro is compatible with some drones (e.g. 3DR Solo) and the company has announced plans to produce their own drone in 2016. The long term success of the company may be pinned to how well they execute their drone strategy and if it can arrive in time.

Frank Schroth is editor in chief of DroneLife, the authoritative source for news and analysis on the drone industry: it’s people, products, trends, and events.

Email Frank

TWITTER:@fschroth

[…] Original Story: Drone Life […]