Advanced Air Mobility Industry Predictions

Advanced Air Mobility (AAM) includes “both Urban Air Mobility (UAM), which involves transporting persons and cargo above the traffic within a city, and Regional Air Mobility (RAM) which is focused more on connecting suburbs, villages and small towns in the countryside as well as islands or communities separated by mountainous regions and rivers,” writes DRONEII editor Ed Alvarado.

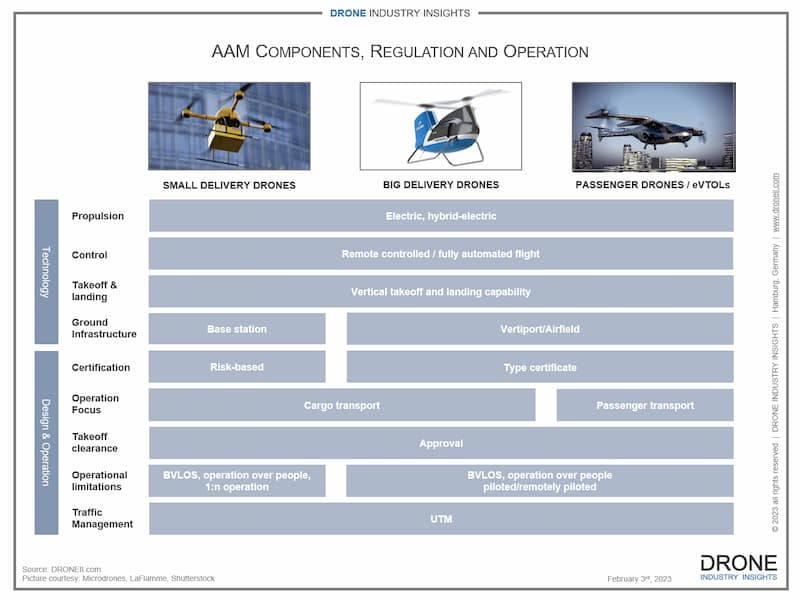

DRONEII’s report predicts that the AAM industry will grow to US$20.8 billion by 2035, at a CAGR (compound annual growth rate) of 22.1%. (Download the DRONEII infographic seen below here.)

Transportation: eVTOLs

Electric Vertical Takeoff and Landing vehicles, or eVTOLs, are in the news: that’s because DRONEII reports more than 350 companies involved in the space, with more than 600 concepts. eVTOLs are lighter than traditional helicopters: most manufacturers plan for 4 seat capacity. Only 5% of these concepts, however, are currently in the testing phase of the certification process – so while interest and activity remains high, few players are currently ready to deliver. Advancements in design, however, have led to major improvements in eVTOL technology, Alvarado writes:

Over time, the design of eVTOLs has advanced from pure multirotor configurations to augmented lift, vectored thrust, and lift-and-cruise configurations. These designs aim to use aerodynamic lift from small wings to fly more efficiently over long distances, while still maintaining compactness and weight savings through the use of multirotor configurations for short distances. In addition, reducing noise through the use of distributed electric propulsion and computational fluid dynamics is a priority, as eVTOLs will operate in urban areas.

Cargo Drones

Retail and residential drone delivery are being tested across the country, but as of yet are not common in urban areas. Where DRONEII sees big value, however, is in large cargo drones. “Transporting cargo to remote places (e.g. off-shore oil rigs, islands, etc.) often requires slow and costly solutions. Large cargo drones can leapfrog the price-intensive construction of ground infrastructure (e.g. a new road, train track or ferry slips) and deliver goods directly to the point of consumption. However, the combination between direct, first-mile/last-mile, mid-mile/feeder, and hub forwarding will be a key component for the logistics and success of drone delivery.”

AAM Infrastructure: Vertiports and Landing Pads

One of the issues with the AAM industry is the need for some physical infrastructure, including vertiports for takeoff and landing, maintenance, and storage. While several designs and test builds have been developed in the last 2 years, for AAM to really take off, both regional and national government agencies may need to support AAM infrastructure construction.

Read more:

- The Top Drone Service Providers in the Industry: DRONEIIs Picks for 2022

- From the Floor of INTERGEO: DRONEII on the Biggest Surprise in Drone Industry Projections

- DRONEII Drone Market Report: Where the Drone Industry Will Grow the Fastest by 2030

- DRONEIIs Drone Industry Barometer 2022 is Out: Why Most Companies Use Drones

- DRONEII’s Kay Wackwitz: 3 Observations on the 2022 Drone Industry

Miriam McNabb is the Editor-in-Chief of DRONELIFE and CEO of JobForDrones, a professional drone services marketplace, and a fascinated observer of the emerging drone industry and the regulatory environment for drones. Miriam has penned over 3,000 articles focused on the commercial drone space and is an international speaker and recognized figure in the industry. Miriam has a degree from the University of Chicago and over 20 years of experience in high tech sales and marketing for new technologies.

For drone industry consulting or writing, Email Miriam.

TWITTER:@spaldingbarker

Subscribe to DroneLife here.

Drone industry analysts

Drone industry analysts

[…] Superior Air Mobility Business Predictions: the DRONEII Report […]