from directionsmag.com‘s Bill McNeil

The mere mention of “drones” conjures thoughts of bombs and missiles raining down on unsuspecting bad guys. However, most of today’s drones, more accurately described as unmanned aerial vehicles (UAVs), are or will be focused on generating data to solve peace-time applications.

UAVs range in size and cost from Northrop’s Global Hawk at $200M, with an endurance of 32 flying hours, to the $40 Powerup paper airplane driven by a small electric motor and controlled from a smartphone using Bluetooth. This article will focus on “prosumer” UAVs, smaller craft used for capturing remotely-sensed information. These aircraft are generally priced under $5,000 and in our opinion will be the game changers with respect to generating data for GIS applications.

1. The Technology

Over the last 15 years a confluence of technology has transformed radio controlled (RC) model airplanes, the kind hobbyists have been flying for decades, into unmanned aerial vehicles. Specifically, the ability to acquire GPS signals enables drones to fly autonomously. Prior to this capability, RC model airplane pilots needed to have visual contact with their plane. If they couldn’t see it in flight, they couldn’t control it. In most cases this fact limited the flight area to less than a couple hundred yards. Adding GPS receivers to drones enables pilots to control their UAV without seeing the entire flight path.

More recently, Wi-Fi technology has been added to the UAV mix in the form of First Person View (FPV). Drones with Wi-Fi cameras, such as GoPro and integrated cameras from DJI and Parrot, stream near real-time video of the flight to a smartphone or tablet. In other words, even though you may not have visual contact with the UAV, as it autonomously flies a waypoint route, you see what the drone “sees” as it flies. This capability allows pilots to alter the flight path, for further inspection, or build a new set of waypoints for the next flight.

2. Unmanned Aerial Vehicle Components

Multi-rotor copter UAVs typically have several components: an aircraft, a gimbal and a payload or instrument(s) attached to the gimbal. Without these components the aircraft is more a hobbyist model airplane than a drone.

The gimbal is a device attached between the drone and the payload the aircraft is carrying. It is a stabilizing platform that, for the most part, eliminates vibrations that cause what is called the “jello effect.” DJI’s Phantom 2 UAV with a Zenmuse H3-D3 gimbal and GoPro camera are pictured in Figure 1. Gimbal and camera are also shown separately.

Also pictured below are 3D Robotics’ fixed wing 3DR Aero drone and Lehmann Aviation’s LA100 with a GoPro camera. Fixed wing UAVs are more stable in flight and therefore they may not require gimbals.

It’s important to remember that drones make data collection affordable but the UAV payload does the actual process of gathering data. Depending on the application, payloads can be action, inferred, or thermal cameras, high precision barometers or multispectral, LiDAR, or hyperspectral sensors.

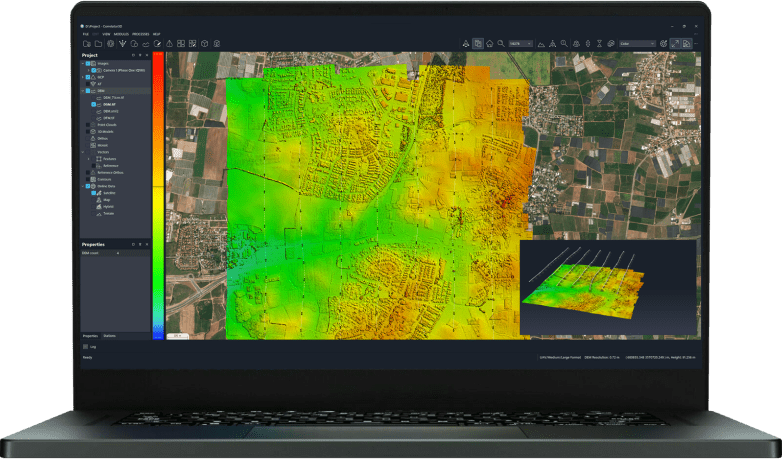

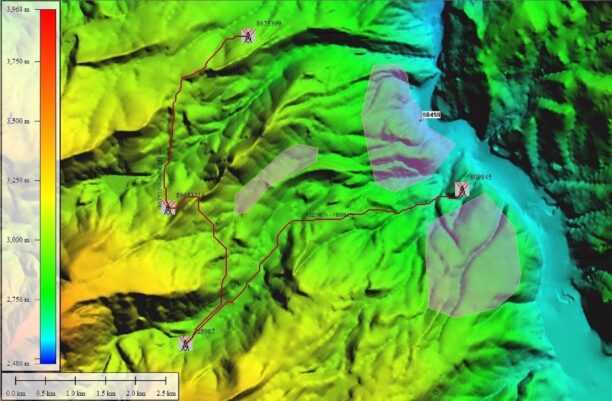

Much of the data gathered by UAVs needs to be processed. Ortho-correction, mosaicking and terrain extraction are just some of the data processing software tools available from various developers. Considering that software is an integral UAV component, many advocates feel the name should be changed from unmanned aerial vehicle (UAV) to unmanned aerial system (UAS).

3. The Applications

Drones will not create new GIS applications but will rapidly expand existing markets because they can access data less expensively than current methods. In other words, it will be far less costly to task a drone to gather inferred data from a forest flyover than, as in the past, to use a pilot and plane to collect the same data.

The following is a partial list of industries that will be disrupted by the use of aerial robots: remote sensing, weather monitoring, oil and gas exploration, transmission line monitoring, surveying, filmmaking, precision farming, terrain extraction, ortho-mosaicking, digital image analysis and 3D topographical imagery analysis.

4. The Market

Once regulations are in place, the Association for Unmanned Vehicle Systems International (AUVSI) forecasts the UAS industry could raise the domestic economy by at least $13.6B and, within the next three years, create 70,000 new jobs. The AUVSI further estimates the economic benefit could be more than $82B by 2025.

According to a May 11, 2014 Wall Street Journal article 3D Robotics sells about 2,000 autopilots per month to drone manufactures or hobbyists and, according to Chris Anderson of 3D Robotics, DJI sells three times that amount.

In a related Wall Street Journal article dated July 8, 2014, Estes-Cox Corporation sold 500,000 remote controlled nanodrones. They are 1.8 inches square and sell for $40.

Funded UAV Companies

The following is a partial list of U.S. companies that have received venture funding (Crunchbase source):

Airware – $40.4 M

3D Robotics – $35M

Skycatch – $19.7M

Crescent Unmanned Systems $250,000

The following is a partial list of U.S. companies that have received crowd-funding (Kickstarted source):

Flexbot -$500,000 with 4,670 funders

Airdroids – $929,212 in pledged money

PowerUp – $1.23M

5. The Barriers to Success

The biggest immediate problem the U.S. UAV industry has is government regulation, or perhaps more accurately stated “lack of regulation.” Drone flights in Canada, Australia, Japan and many European countries are already regulated. This means unmanned aircraft organizations in these countries know where, what and when they can fly.

In the United States, the FAA controls the National Airspace System (NAS). It has long exempted noncommercial flights of unmanned model airplanes from rules that govern private and commercial aircraft. Although UAVs are also unmanned, the FAA wants more control over commercial flights of these vehicles. In the recent past it has sent warnings, threatened lawsuits and, in at least one case, attempted to levy a $10,000 fine against a commercial drone pilot.

The Wall Street Journal article of July 21, 2014 reported: “Despite the FAA’s threats, more than 1,000 farmers attended a recent trade show in Decatur, IL, called the Precision Aerial Ag Show. A report by the Midwest Center for Investigative Journalism found that the value of using drones to manage crops – identifying diseases and pests, for example – outweighs the legal risks. But it also reported that farmers were told that many of the most advanced drones are not available in the U.S. because of the risk of FAA prosecution against manufacturers.”

Some regulations are supposed to be in place by the end of this year; the remaining framework will be added in 2015. Until these regulations become law, the U.S. UAV industry is in somewhat of a holding pattern.

Aside from the regulatory concerns, there are technical challenges. Multi-copter drones have limited range; most can fly no more than 25 to 30 minutes. Fixed wing aircraft have a longer range but they require a catapult or some type of runway.

Another confounding issue is infrastructure. Drones can gather data autonomously but most UAVs still require a pilot to oversee the flight and facilitate landings and takeoffs. This is especially true for fixed wing drones. In other words, even after the regulations are in place and the range problems are mitigated, there won’t be enough qualified pilots to provide the needed services.

Continue Reading at directionsmag.com…

Alan is serial entrepreneur, active angel investor, and a drone enthusiast. He co-founded DRONELIFE.com to address the emerging commercial market for drones and drone technology. Prior to DRONELIFE.com, Alan co-founded Where.com, ThinkingScreen Media, and Nurse.com. Recently, Alan has co-founded Crowditz.com, a leader in Equity Crowdfunding Data, Analytics, and Insights. Alan can be reached at alan(at)dronelife.com

Leave a Reply