International research organization Interact Analysis has just published another estimate of the commercial drone industry.

International research organization Interact Analysis has just published another estimate of the commercial drone industry.

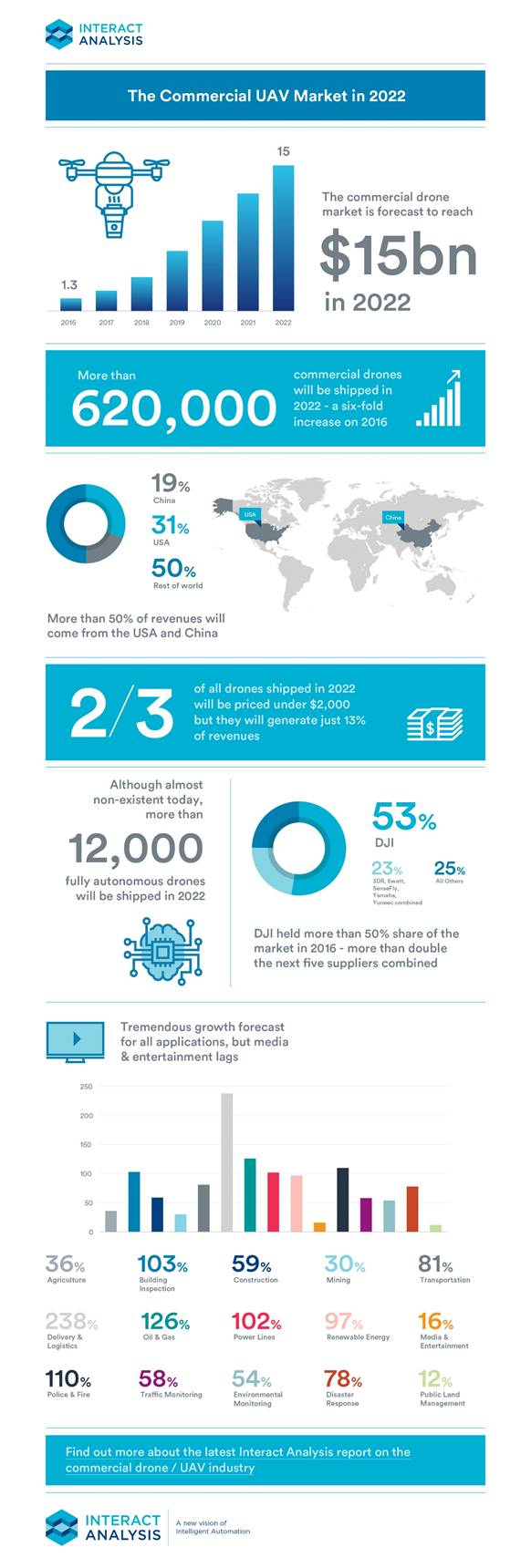

Like most of the research published about the drone industry, the report is optimistic (although less exuberant than some – Interact Analysis estimates that industry revenues will reach a mere $15bn by 2022.) That $15bn includes every aspect of the industry: hardware, software/analytics and drone services. But the estimate still represents an extremely steep rise, from the same firm’s 2016 figure of $1.3bn.

Assuming they are correct, which firms will benefit from the $15bn market? Interact says that DJI’s mixed offering – the “prosumer” model – keeps them on top.

“DJI’s dominance of the consumer drone market is also very evident in the commercial sector. The company held a 53% share of the market last year – more than double the share of the next five largest suppliers combined,” says Interact. “When you exclude “prosumer” applications, DJI’s share drops considerably, however.”

Other conclusions of the report:

- “Rapidly increasing penetration rates into a huge number of commercial applications will drive a six-fold increase in drone shipments, surpassing 620,000 units in 2022.” Researchers see the growth of service providers as limiting hardware growth.

- “Demand will be dominated by two countries – the USA and China – and will account for more than 50% of industry revenue in 2022.” The report predicts that the US will remain the largest commercial drone market until 2022, due to recently relaxed regulations and total opportunity. The report also predicts that China will increase their market for commercial drones, especially in agriculture, police and fire, and infrastructure verticals.

- “Low-cost drones (<$2,000) dominate the commercial market currently. But whilst they will account for 2/3 of shipments in 2022, they will only generate 13% of revenues as enterprises shift toward ‘industrial-grade’ products.”

- Fully autonomous drones are the next big thing. While currently limited by both public perception and regulations, researchers anticipate that more than 12,000 autonomous drones will be shipped in 2022.

- “All…application sectors we analysed are forecast for massive growth over the next five years.” However, researchers anticipate that the dominant media market will be dwarfed by other commercial sectors going forward. Delivery and logistics, while significant, will remain a small portion of the market throughout the next 5 years.

Miriam McNabb is the Editor-in-Chief of DRONELIFE and CEO of JobForDrones, a professional drone services marketplace, and a fascinated observer of the emerging drone industry and the regulatory environment for drones. Miriam has penned over 3,000 articles focused on the commercial drone space and is an international speaker and recognized figure in the industry. Miriam has a degree from the University of Chicago and over 20 years of experience in high tech sales and marketing for new technologies.

For drone industry consulting or writing, Email Miriam.

TWITTER:@spaldingbarker

Subscribe to DroneLife here.

[…] Consider how airlines have already been hit hard by the COVID-19 pandemic, as travel plummets on the lists of would-be travellers’ priorities. Thousands of pilots have already been laid off. Some have actually turned to piloting drones as a stop-gap measure, but, as alluded to earlier, the trend is shifting to pilotless, with market-research-firm Interact Analysis having predicted more than 12,000 autonomous drones will ship in 2022. […]