Xponential, one of the largest trade shows focused on the commercial UAV industry, took place last week and, being a trade show, it was energizing, invigorating, exhausting and, at times, slightly insane.

One word heard over and over, a word that was on the tips of everyone’s lips was “opportunity.” Asked about his time at PrecisionHawk to date, Michael Chasen, the CEO who came on board last January, said “[It is ] so much fun . . . and there is so much opportunity.” Waiting for the Startup Showdown to begin a woman seated nearby commented, “I am here for the opportunity.” Everywhere you turned someone was talking about the “opportunity.”

This optimism that the sky is our oyster was evident in the entry by aviation behemoths into the commercial UAV market. Dirk Hoke, CEO of Airbus Defense and Space, announced the launch of Aerial Acuity, a data analytics platform that marries information from high-resolution satellites along with fleets of unmanned aircraft to deliver solutions targeted at specific industries such as agriculture. Similarly, Lockheed Martiin announced a new version of the their Indago drone “for military and commercial markets”. It is a very impressive quadcopter but . . . can you successfully sell to military and commercial markets? Those are pretty different beasts. The sales channels are different, the needs are different and the most importantly, the thinking is different. A representative from Lockheed said they were working on a ground controller that would enable pilots to work with both Lockheed quadcopters and fixed wing drones. Is that innovation?

Xponential gave a lot air time to these aviation giants. They were sprinkled throughout the show at keynotes and the like but that was not where attendees found the energy. The energy was in the cages. Drones are about flight and two companies had flight cages on site. One is quickly establishing itself as the industry leader in drone engineering and manufacturing, the other is a tech giant that continues to demonstrate an ability to adapt to emerging markets. They are DJI and Intel respectively. Asked how DJI has managed to establish such a lead over other firms (e.g Yuneec, 3DR,etc), Michael Oldenburg, senior communications manager for DJI said, “Three words: innovation, innovation, innovation.” And that was on display in their cage where they were demonstrating their technology. One of the highlights being FPV goggles that can control the camera view through head movement. That was compelling. As for Intel, they are not sitting still. They have acquired Movidius and Ascending Technologies. The former a developer of sensors (they engineered the sense and avoid technology found in DJI drones) and the latter a drone manufacturer.

Another theme rippling through the show, which also illustrates a problem that the aviation giants may have in cracking the market, is the increasing adoption of a freemium business model. Lockheed doesn’t do freemium. But there are a number of drone start ups that do. And these start ups are focused on what has been identified as the sweet spot — data analytics. DroneDeploy has offered its software for free for some time. PrecisionHawk announced at the show that their PrecisionMapper software is now free. Why? In the words of PrecisionHawk CEO Michael Chasen, “it’s getting great data in the hands of businesses quickly and that can accelerate the industry.” To realize the opportunity that everyone is talking about is going to require that the markets (agriculture, mining, construction) get educated and convinced of the value. There is work to be done and these companies, and others such as KittyHawk, another proponent of the freemium model, understand that.

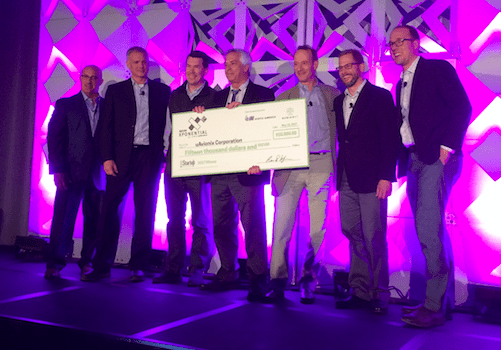

One last jolt of energy was to be found at the Startup Showdown where all three of the finalists were U.S. based engineering firms. They are all in process of developing innovative technology that will advance the industry. They were:

- Inerital Sense which develops amazing micro navigation systems.

- uAvionix Coproration which won the competition for its avionics components that assist in flying unmanned aircraft safely and legally. Their products, ranging from 5 to 100 grams, provide UAS tracking, surveillance and navigation solutions. uAvionix also provides solutions to manned aviation and airport operations.

- WiBotic, Inc. which is a wireless power solutions company promoting fast and automated charging for robotic systems.

So what is the key takeaway? There is tremendous opportunity but what it will take to realize that opportunity is less clear. But the bet has to be on the startups that are innovating (products, business models etc) and the companies that are adapting that are most likely to realize it.

Related Links

- Airbus Aerial

- DroneDeploy

- PrecisionHawk’s PrecisionMapper

- Kittyhawk

- Lockheed Martin Indago UAS

- Intel Drone Technology

Frank Schroth is editor in chief of DroneLife, the authoritative source for news and analysis on the drone industry: it’s people, products, trends, and events.

Email Frank

TWITTER:@fschroth

[…] Xponential, one of the largest trade shows focused on the commercial UAV industry, took place last week and, being a trade show, it was energizing, invigorating, exhausting and, at times, slightly insane. One word heard over and over, a word that was on the tips of everyone’s lips was “opportunity.” Asked about his time at […] The post What Did Xponential Tell Us About the State of the Commercial Drone Industry appeared first on DRONELIFE. See Original Article […]