Features should appeal to Esri users, but will they appeal to non-Esri users?

QuickTake

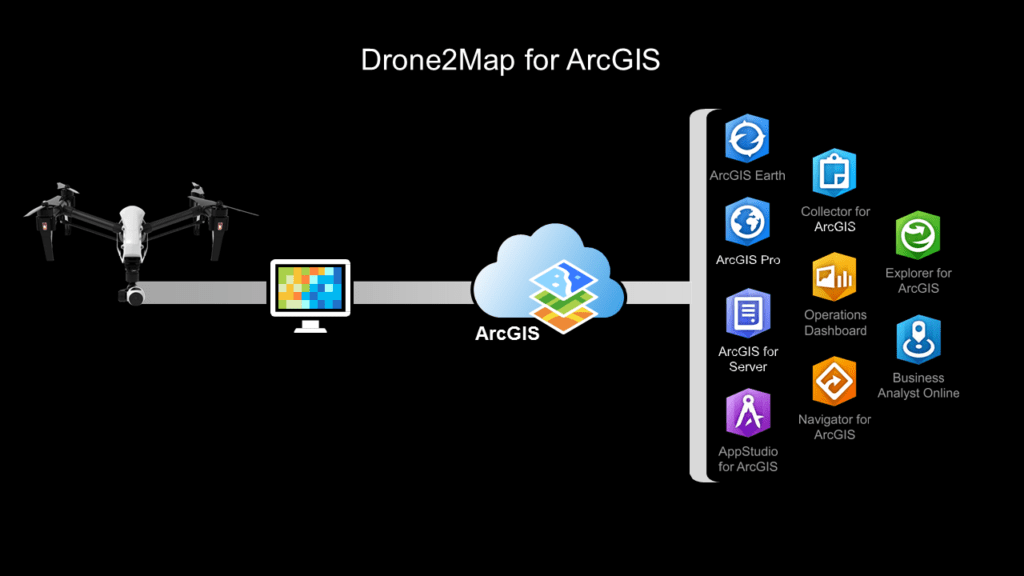

THE FACTS: In February 2016, Esri released an application called Drone2Map for ArcGIS. Drone2Map (D2M) takes raw image data from drones and creates digital surface models, orthomosaics, 3D-point clouds and 3D PDFs that can be shared. Data processed by Drone2Map can also be rendered in Esri’s ArcGIS online web service and integrated into ArcGIS for further processing. The photogrammetry engine in Drone2Map is Pix4D. Esri licenses D2M as a yearly subscription for $3,500 plus a nominal data storage cost.

Click on the image for a larger view. Use back button ot return to article.

Esri’s ArcGIS platform provides maps and a wide variety of analytical tools to governments, business, and utilities. Applications range from finding the optimal retail store location, to mapping pipelines, to planning public works projects. In the past, Esri has been rather lethargic in adopting new technology, but to their credit, they have been a forerunner in recognizing the potential of drone-generated data. This new product is proof of that.

WHAT’S COOL AND WHAT’S NOT: If you don’t know Esri, then you don’t know geographic information systems (GIS). ESRI so dominates the GIS industry that the name GIS and Esri are almost synonymous. Esri has been doing business since 1969, has 9,000 employees in 67 countries, 41 offices worldwide, and has annual sales north of $900 million dollars.

More than 350,000 organizations use Esri products, but the number of users is actually much larger because many of these companies have licensed multiple copies of their software. In other words, Esri’s user base is large enough be a market in itself. The D2M feature set, combined with ArcGIS integration, should be appealing to current Esri users.

On the downside, Drone2Map only becomes an end-to-end solution when it is used with the ArcGIS platform, making it an additional cost consideration for non-Esri users. Also, sales of D2M, like other drone data solutions, will be paced by the speed at which drone technology is adopted by enterprises and the data is integrated into the GIS workflow.

THE COMPETITION: Harris Geospatial Solutions and Icaros, Inc. have formed a partnership that enables Harris to sell Icaros’s One Button imaging processing software. Like Drone2Map, OneButton generates 2D, 3D, and orthorectified images from drone data. OneButton may not attract Esri customers, but it will be a compelling alternative for those who don’t use Esri tools.

There is an irony in Esri’s offering—Pix4D is both a supplier to and a competitor with Esri. Irony aside, we see this as a win/win situation for Pix4D because, being part of Drone2Map, they profit from each Drone2Map sale and from sales to non-Esri customers.

There is another twist in the story here. Esri announced last month a beta integration of its ArcGIS software with the very popular DroneDeploy software. But right now, DroneDeploy offers much more to surveyors and mappers than Drone2Map because it offers a simple mobile app for mission planning, data-to-cloud upload, and the same sharable data analysis (digital surface models, orthomosaics, 3D-point clouds, 3D PDFs, etc.) that Drone2Map does. It seems to us a push-button integration to ArcGIS just makes DroneDeploy more valuable.

BOTTOM LINE: Drone2Map for ArcGIS is important to Esri because it works on several different levels. For one, the strong feature set and ArcGIS integration should attract current users. If one half of one percent of Esri’s 350,000 users purchase Drone2Map, Esri will realize a revenue gain of over $6 million.

In addition to generating revenue from their user community, Drone2Map also works as an Esri promotional tool. Drone companies like 3D Robotics, senseFly, and Drone Deploy all want to promote their solutions as working with Esri products. This is free publicity and introduces prospects outside of Esri’s user base to the company.

Drone2Map should sell well to the Esri user base but considering the fact that it is not a complete mobile end-to-end solution, Esri will be challenged to successfully find new customers outside their user base. Also, the commercial drone industry is fast moving and very fluid. Esri may have a difficult time keeping up. However, you can never count Esri out. Once the market settles, Esri will be a formidable competitor.

Colin Snow is CEO and Founder of Skylogic Research, LLC (aka Drone Analyst®), a research, content, and advisory services firm for the commercial drone industry. Colin is a 25-year technology industry veteran with a background in market research, enterprise software, electronics, digital imaging, and mobility.

Colin Snow is CEO and Founder of Skylogic Research, LLC (aka Drone Analyst®), a research, content, and advisory services firm for the commercial drone industry. Colin is a 25-year technology industry veteran with a background in market research, enterprise software, electronics, digital imaging, and mobility.

Alan is serial entrepreneur, active angel investor, and a drone enthusiast. He co-founded DRONELIFE.com to address the emerging commercial market for drones and drone technology. Prior to DRONELIFE.com, Alan co-founded Where.com, ThinkingScreen Media, and Nurse.com. Recently, Alan has co-founded Crowditz.com, a leader in Equity Crowdfunding Data, Analytics, and Insights. Alan can be reached at alan(at)dronelife.com

Why bother with Drone2Map when it uses the engine from Pix4D but with reduced options? It’s slightly cheaper and has the ESRI brand but Pix4D is a more versatile product and offers a mission authoring app as well. I just tested the two products as demo’s side by side and there was no appreciable difference between the two at default settings.

Is this good? or too much high cost? compare to what pokemon go doo

Colin could you make comparison with Erdas Imagine UAV software?

Seems drone2map its just another simplified point cloud matching workflow.