(Source: Colin Snow, droneanalyst.com)

On February 15, 2015, the commercial drone industry breathed a collective sigh of relief. The Federal Aviation Administration’s proposed new rules for small unmanned aircraft systems seemed, at first blush, somewhat practical. The FAA regulations will eventually allow commercial operations of drones that weigh under 55 pounds in U.S. airspace, without requiring operators to acquire a pilot’s license. You can read the full 195 pages of proposed rules here (hereafter sUAS notice of proposed rulemaking, or NPRM) and some analysis about them here, here, and here.

On February 15, 2015, the commercial drone industry breathed a collective sigh of relief. The Federal Aviation Administration’s proposed new rules for small unmanned aircraft systems seemed, at first blush, somewhat practical. The FAA regulations will eventually allow commercial operations of drones that weigh under 55 pounds in U.S. airspace, without requiring operators to acquire a pilot’s license. You can read the full 195 pages of proposed rules here (hereafter sUAS notice of proposed rulemaking, or NPRM) and some analysis about them here, here, and here.

In this post, I’ll focus on what I think are the immediate economic winners and losers. My analysis is concentrated on the business impact and market opportunities that the proposed rules have for drones manufacturers, distributors, service providers, and investors.

What do investors need to know?

According to CB Insights data, 2014 investments in the budding drone industry topped $108M across 29 deals. Year-over-year funding increased 104% as venture firms jumped into the drone space with sizable bets. Still, over the past couple of years, I’ve heard VCs and potential investors discussing the FAA bottleneck and questioning whether this was the right time to invest. Regulatory uncertainty has kept many on the sidelines. But this new clarity should help investors, including those interested in investing in operational and data / information services.

Clarity comes in not only knowing what the rules will look like, but also in the FAA’s commitment to no longer regulate UAS like they do manned aircraft — and in no uncertain terms the U.S. Department of Transportation’s (DOT) understanding of the macro-economic impact of commercial sUAS. In a document captioned Notice of Proposed Rulemaking Regulatory Evaluation, Small Unmanned Aircraft Systems, the author states:

“This proposed rule would create an enabling business environment which would encourage the growth of private sector activity in the manufacturing and operating of small UAS. Therefore, the major benefit of this proposed rule is that it would enable new non-recreational aviation activities for small UAS in the NAS where such operations are currently not permitted without an FAA-issued exemption. The private benefits would exceed the private costs if there is only one UAS and that UAS operation earns a profit.”

As noted here, it’s possible this is a leaked early draft that has since been revised or is otherwise incomplete or inaccurate. Still, the DOT evaluation explores in depth four potential markets: aerial photography, precision agriculture, search and rescue/law enforcement, and bridge inspection. These fall more in line with what I believe are the proper commercial market segments:

Precision Agriculture

Inspection / Surveillance

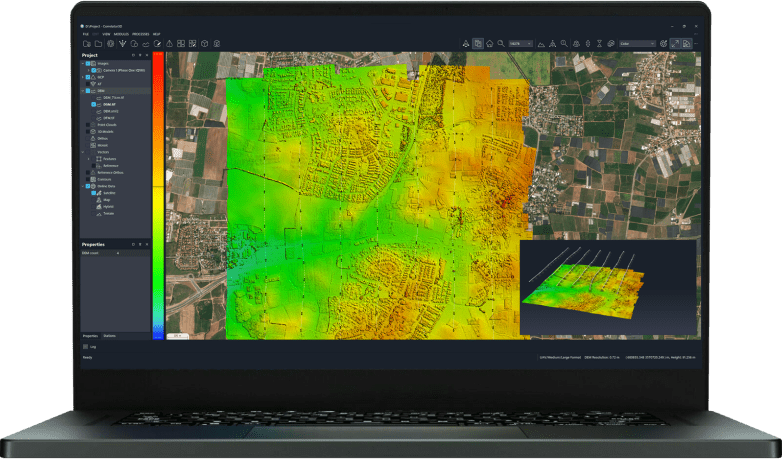

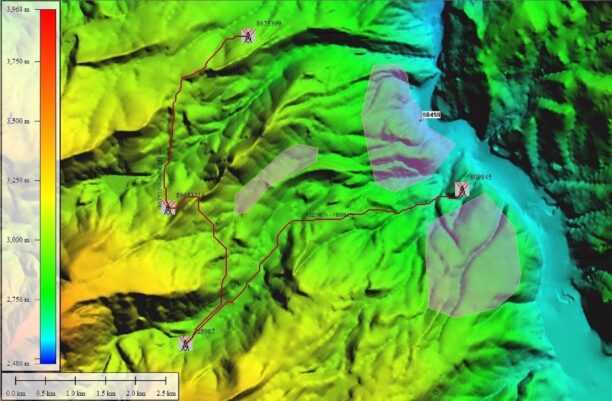

Mapping / Surveying

Film / Photo / Video

Public Safety / First Responders

As I see it, all of these markets are winners, but some are bigger winners than others. The devil is in the details, because success in each market depends what type of sUAS operation the sUAS NPRM allows or doesn’t allow. The FAA summarizes these operational limitations here, and I’ll discuss each market below.

Precision Agriculture – Winner and Loser

Precision agriculture is a farming management concept based on observing, measuring, and responding to inter- and intra-field variability in crops. Precision agriculture uses detailed, site-specific information to manage production inputs. Information technologies enable segmenting a farm into smaller units to determine the characteristics of each individual segment.

For the most part, the proposed rules support the farmer’s and/or researcher’s ability to locate a precise position in a field, observe it, and create maps of as many variables as can be measured — but only on a small scale. That’s because all observation and measurement would have to be done by a drone that is within visual line of site (VLOS) of the operator. The problem is that fields and farms are big– bigger than VLOS.

Sure, operators could conduct many operations in a day by moving section to section to section and stitching together larger maps, but this is costly – both in terms of manpower and time. Even if it was cheaper, the market potential for drones in precision agriculture still needs more vetting. It’s not yet clear how a sUAS can deliver more usable data to a farmer or provide a cost benefit over the existing manned aircraft or the satellite image solutions available to them today (see Film or Farm: Which is the Bigger Drone Market? – Part 2 for more on this).

Bottom line: Demand for turnkey drone systems will increase as farmers and service providers work within the rule constraints (see my list of drone vendors serving agriculture here). However, the big caveat is drone usage alone will not “transform agriculture” just yet. For that, we would need to see a change in the adoption rate for variable rate technology (such as applicators) — which is currently down. So, if you are banking on precision agriculture data services, you will continue to see competition from incumbents and continue to see slow adoption for now.

Inspection / Surveillance – Big Winner

With sUAS’s ability to perform functions like perch-and-stare, video capture, and laser scanning, they are poised to replace many of the dull, dirty, and dangerous functions of inspection and surveillance. The main beneficiaries are civil and public entities that perform enterprise asset management (EAM) and facilities/infrastructure management.

Never is the benefit more evident than in the energy, telecomm, and construction verticals. For example, the sUAS NPRM mentions power-line/pipeline inspection in hilly or mountainous terrain and antenna inspections (page 8f) as examples of possible operations that could be conducted under the proposed framework. The DOT evaluation goes further and dedicates a whole section on bridge inspection (section IV.A.1.d. page 21ff). I would add to this structures like buildings, oil rigs, refinery flare stacks, cell towers, and wind turbines.

GIS professionals should pay particular attention to the bridge example. The National Bridge Inspection Standards (NBIS) mandates that routine inspections be performed at 24-month intervals. With almost 600,000 bridges in the United States and 300,000 requiring inspection each year, the DOT evaluation report estimates that about 45,000 annual bridge inspections could utilize some form of small UAS. Multirotors in particular are highly adept at getting into tight spaces. With advent of smaller/lighter survey grade LiDAR, the combo provides a stable and portable platform for precision scanning of bridges. I think drone products and services that target GIS firms are hot—you can read why here.

Bottom line: Demand for and use of drones (especially multirotors) dedicated to asset and infrastructure inspection will see a big uptick. There is also now a very large opportunity for firms like Accenture and IBM to provide information architecture and data integration services for drone data to existing enterprise and mobile applications like SAP EAM and Oracle EAM. I also see opportunities for companies to provide motion imagery, video analytics, object recognition, and image metadata processing solutions.

Mapping / Surveying – Winner and Loser

As I mentioned above, the new rule supports the ability to locate a precise position, look at it, and collect the data to create maps on a small scale. Again, that’s because all observation and measurement would have to be done within VLOS of the sUAS operator. The problem here is many mapping projects are bigger than what can be captured in VLOS. As in the precision agriculture example, operators could conduct many operations and stitch together larger maps, but this may be more costly than what can be currently conducted by manned aircraft.

Rules aside, good solutions exist today that support autonomous missions beyond line of sight (BLOS) and therefore create large maps in one flight. Some investors in this market may be disheartened by the proposed rules that restrict flight to VLOS, since so much effort has been put into autopilot / mission planning / ground control solutions. Nevertheless, almost all of the existing solutions provide semi-autonomous flight capability where the operator is still in control (or can take back control). You just won’t be able to fly multiple drones at the same time. The proposed rules are one operator, one drone.

Bottom line: The surveying industry has the most to gain here. The door is wide open for drone operations like stockpile measurement and small open pit mine mapping. The door is also open for laser scanning, 3D imaging capture, and data processing that architectural engineering firms can consume. As such, there are new opportunities for dedicated and differentiated cloud-based in-memory processing data services.

Film / Photo / Video – Big Winner

The DOT evaluation dedicates a whole section to aerial photography (section IV.A.1.a. pages 16ff). It says:

“Small UAS industry experts have informed the FAA that a proposed rule could enable a viable market for small UAS aerial photography. These unmanned aircraft operators would likely specialize in low-altitude aerial photography and video. Consequently, once a small UAS aerial photography market becomes established, it would increase safety by substituting an unmanned aviation operation using a very light aircraft for a more complex manned aviation operation that uses a much heavier aircraft.”

Really? The photographic, film, and real estate industries have known for years small UAS are a more viable and less costly substitute for manned aerial photography. It’s also no secret that this market is already established and towers above all others both in revenue and number of existing service providers (see what I wrote about that here).

Bottom line: Drones have already created new sources of demand for aerial photography, and this will continue in earnest. As with land-based photography, the financial and technical barriers to entry are low, making it easy for businesses to begin offering sUAS-based film and photography services. Now that the regulatory hurdle looks to be low, expect aircraft vendors and specialty retailers to flourish, too.

Public Safety / First Responders – Uncertain

The DOT evaluation dedicates an entire section to “Search and Rescue/Law Enforcement” (see section IV.A.1.c. page 19 ff). It describes how small UAS missions can create significant cost savings to federal, state, and local government entities because they offer a more economical alternative to manned helicopters. The report estimates (page 20):

“…a significant number of public entities will contract the services of a small UAS operator. … The FAA and industry expect that some of the larger public entities would train their own operators and purchase and operate their own small UAS. The majority of the smaller public safety departments that could not afford to train their officers to fly a small UAS would contract these services out to commercial small UAS enterprises as the need arises.”

If true, this would create a viable market. But there a few catches. The first catch is the proposed rule does not allow sUAS operations at night. The second is there are or will be local rules to contend with that prohibit certain types of operations, like surveilling criminal suspects. The third is the recent Presidential Memo creating standards for how government agencies and some recipients of federal funds will address the privacy issues associated with drones.

Bottom line: Under the proposed rules, demand for turnkey drone solutions and services for police, fire, and emergency medical services is uncertain. Technology adoption by fire and rescue may be good, but adoption by local and state police agencies will no doubt be fraught with continued controversy over privacy and Fourth Amendment rights.

Conclusions

Almost all drone industry insiders expect the clarity about forthcoming rules to foster investment that will create new jobs and spur economic growth — if not now, certainly when the proposed rules become law in 2016 or 2017. Expect then to see increased productivity, improved worker safety, and saved lives. In the meantime, the FAA wants to hear from you about the proposed rules (see 31 Questions the FAA Wants you to Answer).

I would love to hear your thoughts about the proposed rule for commercial drone use. Feel free to comment or write me at colin@droneanalyst.com.

Continue Reading at droneanalyst.com…

Alan is serial entrepreneur, active angel investor, and a drone enthusiast. He co-founded DRONELIFE.com to address the emerging commercial market for drones and drone technology. Prior to DRONELIFE.com, Alan co-founded Where.com, ThinkingScreen Media, and Nurse.com. Recently, Alan has co-founded Crowditz.com, a leader in Equity Crowdfunding Data, Analytics, and Insights. Alan can be reached at alan(at)dronelife.com

Leave a Reply