![]() Guest Post: This article published with permission from our partners at DroneII, Drone Industry Insights.

Guest Post: This article published with permission from our partners at DroneII, Drone Industry Insights.

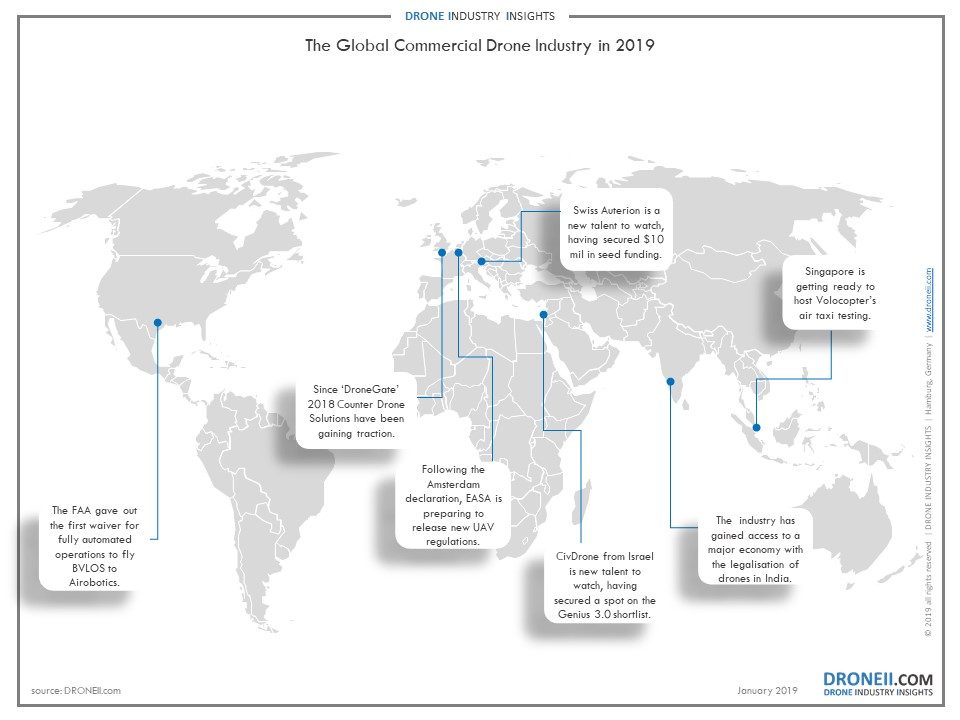

The Commercial Drones Industry: Global Outlook 2019

Happy New Year from DroneII! Hitting the ground running in 2019, we would like to start a timely conversation this year about the key trends in the commercial drone industry to focus on. As the industry consolidates the market will become a harsher environment as companies race for time and funding to successfully introduce their products. Meanwhile, a lot of new and massively funded companies will pop up having done their homework in stealth mode alone or under the wing of larger corporations. To kick off our January publications, here are the trends, laws, tech and players to watch this year.

New Developments

Responsible Consolidation

As the hype around drones dwindles, the ‘winners’ in the market will continue developing technologies to fully integrate drones and begin to offer end-2-end (E2E) solutions, a combination of hardware and software which can fully meet the need of customers without the need for another vendor. However, consolidation is not a one-way street, there are risks of companies expanding irresponsibly. For example, PrecisionHawk recently acquired HAZON Solutions and InspecTools, two companies in the drone energy sector, yet they also allegedly laid off 40 staff members. While PrecisionHawk has now acquired tools that should enable them to combine collecting and analysing drone data, their downsizing suggests that they may have been unprepared for such steps.

From Prosumer to Professional

As we near the end of the proof of concept phase in the commercial drone industry and as the technology is proven to be reliable, there will be a growing demand for job specific drone platforms. Yet, on the other hand the Chinese giant DJI still dominates the market with over 70% of the share. 2019 will thus be an interesting year as we’ll be able to see how these two dynamics affect each other.

For Sale Rent

We have already seen a shift from local data processing to cloud-based data processing. Through the leasing model initial software costs have decreased for many making that software more affordable for many companies. This trend is likely to continue and seep into the hardware market, as smaller companies continue to enter the market seeking affordable solutions to high entry costs. Companies like Kespry and LiDARUSA companies are businesses the opportunity to lease drones as opposed to having to purchase them. This will provide a cheaper option for companies to trial drones thus lowering the entry barrier to adopting drone technology.

New Regulation

A Common European Drone Services Market?

Early on in the year we expect to finally see the new EASA regulations adopted, a long awaited update of the 2015 regulations (see our article on this here). In November European and national stakeholders adopted the Drones Amsterdam Declaration. It prioritises supporting Member States in implementing technical rules to enable drone flights over longer distances, using the European U-space Demonstrators Network to carry out safe, secure and green drone operations and to develop a U-space system. The adoption of the Amsterdam declaration suggests that the EASA will pass Opinion 01/2018. Realistically these regulations will be adopted by the end of the first quarter, but it will take another year them implemented on a national level. Nevertheless, this is a space to watch as there is clearly a big push at EU level to continue to adapt the regulatory environment to the increased presence of UAVs. SAFIR, a European Commission consortium of 13 public organisations and private companies aiming to assist the EU in establishing a traffic management system commercial drones, will also be running tests and demonstrations in Belgium this year.

Legalisation of Drones in India

On December 1st it became legal to fly drones in India as the Ministry of Civil Aviation finalised a national drone policy. However, although drones will be used for mapping, inspection and monitoring, especially collecting data in agriculture and supporting insurance companies, e-commerce delivery is not on the table for now. The only products that will be delivered are emergency healthcare provisions in situations when there are obstacles to deliveries by land. A study by the Observer Research Foundation (ORF) revealed that the measures taken by the state and central government in India have been ineffective as questions of privacy, air traffic, terrorist threat management, and legal liability have not been adequately addressed. Regardless, this legalisation has put a major economy on the commercial drone market and India should definitely be on the map as a space to watch in 2019.

BVLOS, FAA Waivers

2019 could also see an increase in Beyond the Visible Line of Sight (BVLOS) missions, although not their standardisation. In 2018, Airobotics was the first company in the United States to receive a waiver from the FAA for flying BVLOS in fully automated drone operations over human beings. This waiver sets an important precedent as it shows that the FAA is ready to allow for a high degree of automation meaning suggesting that other companies will be able to follow suit this year should their technology be sophisticated enough.

New Tech

More Integrated Networks

The integration of hardware and software solutions (E2E) is critical for further scale and adoption as a driver for commercial drone usage across individual operators and large organizations alike. Our research has shown that industry stakeholders also see E2E as the driver of commercial drone usage. Companies will seek well-balanced and harmonised solutions which use both hardware and software and upon adoption don’t require a steep learning curve in tuning the equipment or software.

More AI

The integration of artificial intelligence especially for data analysis will be a driving theme in the drone industry in 2019 as companies are already working towards AI-driven solutions. For example, defect detection software provider Ardenna currently monitors railway track defects using computer vision software on a UAV payload meaning they can detect any potential obstructions or rail breaks in real time. However, they are also currently collecting reference data (millions of aerial pictures of train tracks) to thoroughly train a machine learning algorithm. This is a step that once completed will massively increase productivity. But the data collection and training are long and arduous processes as the industry players must put in a significant amount of legwork this year to be able to see any fruits of their labour (for more on AI and drones see our post dedicated to it).

Counter Drone Solutions

Following DroneGate at Gatwick at Christmas there is likely to be an increase in demand for counter drone solutions as both Gatwick and Heathrow airports have already invested millions in anti-drone technology. Institutions and companies are increasingly asking how can we protect critical infrastructure and ordinary people from malicious drones? The answer is likely to feature a mix of more expansive regulation and more advanced technology. Dedrone, for example, released their latest DroneTracker (3.5) in 2018 which detects, localizes, and tracks simultaneous drones and swarms to protect against advanced drone threats. The rise in the awareness of the threats that rogue drones can present are likely to increase the demand of more of such companies and technologies.

Air Taxis

With plenty of debate over whether unmanned air taxis are overhyped, undeniably these technologies will be in the spotlight in 2019. Commercial unmanned air taxis won’t be up and running for at least a few years, but in 2019 many will be testing their prototypes. Boeing acquired the pioneer Aurora Flight Sciences last year and will be testing their prototype air taxi in 2019. While there are impressive well-funded start-ups like Volocopter in the market, we’ll see mainly larger companies racing to develop and test the most advanced capabilities and acquire certification (a long and costly process).

New Talent

Auterion, Zurich, Switzerland (2018)

Auterion, although established only last year, managed to secure $10 million in seed funding and is currently the largest open source drone software company. They built the open source operating system for commercial drones on top of PX4, the most widely used flight controller for drones.

Civdrone, Tel Aviv, Israel (2017)

Civdrone is a Tel-Aviv based construction start-up seeking to revolutionise land surveying. They develop fast, reliable and autonomous marking solutions on enterprise drones for the construction industry. Last month they made the final shortlist for the GENIUS NY business accelerator program, which is the largest business accelerator competition for the UAS industry in the world and certain to increase their funding in 2019.

Project AlphaLink, Berlin, Germany (2017)

Founded in Berlin, Project Alphalink is a High-Altitude Platform (HAP) seeking to bring internet to remote places that currently lack sufficient infrastructure to enjoy the benefits of the World Wide Web. In 2018 they were selected to participate in the IAF Startup Pitch Session and won the 3rd prize in the Life Sciences & Technology category of the Research to Market Challenge.

Stormbee, Ghent, Belgium (2017)

Stormbee engineers, designs and manufactures customised application solutions using UAV technology and 3D laser scanning. They recently partnered with Neolaser Solutions, a leader in laser solutions in Singapore, to expand their reach into the East Asian markets.

SkyWatch, Palo Alto, United States (2016)

SkyWatch is a US-Israeli drone insurance start up. They provide on-demand drone insurance, an affordable flight safety tool for commercial and recreational pilots. In 2018 they raise $2 million in seed funding and got certified as insurers in all 50 US states.

Find Out More

Want a more in-depth insight into market developments, regulation, technology or companies to watch in 2019? Reach out to us to discuss more tailored studies.

Contact us here.

Disclaimer

This article covers merely a snippet of the trends in the commercial drone industry; it is by no means an exhaustive list of up and coming companies watch in 2019.

*In case you missed some of our more recent content, here is our Drones in the Energy Industry report and our post on Drones and Artificial Intelligence.

Miriam McNabb is the Editor-in-Chief of DRONELIFE and CEO of JobForDrones, a professional drone services marketplace, and a fascinated observer of the emerging drone industry and the regulatory environment for drones. Miriam has penned over 3,000 articles focused on the commercial drone space and is an international speaker and recognized figure in the industry. Miriam has a degree from the University of Chicago and over 20 years of experience in high tech sales and marketing for new technologies.

For drone industry consulting or writing, Email Miriam.

TWITTER:@spaldingbarker

Subscribe to DroneLife here.

[…] interesting fact about the drone industry and as reported by The Economic-Report is that the annual revenues of the drone industry are […]