The changes and developments we saw throughout the drone industry in 2017 were incredible and deserve a proper examination. For the most part, the hype that drove so much misunderstanding and frustration in this space is gone,and that’s a good thing. While the kind of hype we’ve seen associated with UAVs can create needed attention, it can also lead to irrational behavior and impossible expectations. Now that we can get a better sense of when drones will be able to reach the “plateau of productivity” from the Gartner Hype Cycle, we can finally talk about the organizations and uses of this technology that will truly drive and define the drone industry.

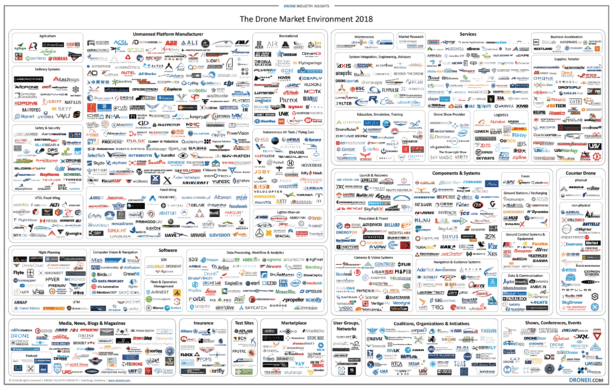

How does our Drone Ecosystem Map help define what these developments look like in 2018 and beyond though? First, it provides a great overview of the most active and relevant players in the drone industry in their category and sub-category. We limited the Map to 1,000 players so you can focus on the companies and people that are set to have the biggest impact on the drone market. The Map is not totally comprehensive, and it’s not supposed to be. The focus is on the diversity and reach of this drone ecosystem.

The second way it can help is directly related to the first, since the Map can help you uncover niches and players you might not otherwise come across in this vivid market. Since we’re not trying to provide you with an all-encompassing look at the drone industry as a whole, you can use the Map to find technology and organizations that can make for ideal partners. We’ve heard from countless people who got in touch to say they used the previous version of this Map to locate strategic partners. This is a resource that has led to a great deal of investment for people on every side of the drone industry. Transparency can and does drive decisions in this space, and that’s why we want to share our knowledge with anyone who is or will be making a decision about drone technology.

If we look at the drone industry a whole in 2017, we can see a clear movement towards investment in software. Many companies realized that it’s not the drones themselves that provide value for users, but instead it’s the data they’re gathering. This is part of the reason we’ve seen such a dramatic increase in strategic partnerships. Stand-alone drone hardware is not what commercial customers are looking for when considering drone technology. Many of the players in the drone industry realized that creating a complete solution was the best approach, and that desire drove many of these strategic partnerships.

If you compare the 2016 and 2018 Maps, you can see some interesting trends that have and continue to permeate the drone industry. 10% of the companies listed (711 total entries) in the 2016 map are gone. 360 new entries were added, which is indicative of the strong movement that we’re seeing in almost every sector. It’s impossible to stay on top of all these movements though, as major changes like GoPro moving away from the drone business took place in the first couple weeks of 2018. We’ll see more headlines like these throughout the year, as this market continues to be defined before our eyes. Now let’s take a closer look at the most important developments in the drone industry:

Platform Manufacturers:

- A great deal of consolidation is happening, and that’s something you can see with the mergers, acquisitions, drop-outs and focus changes. 3DR, PrecisionHawk, and Agribotix have moved away from hardware and are now mostly or wholly focused on software. Much of this has been triggered by the market superiority of DJI. 3DR officially noted that competitive pricing was a key reason for their $100m failure in hardware.

- There’s a trend toward strong specialization in specific industries and with custom configurations. Agriculture, delivery systems, safety & security are some of the bigger industries that are seeing this development of specialization. That’s being augmented by specialized configurations, which have also created new niches and provided unique selling points. These configurations include fixed-wing, VTOL fixed-wing and lighter-than-air.

- The AAT’s (Autonomous Air Taxis – also called flying-cars or e-VTOLs) sector has come on in a big way, and there’s a lot of funding in this space. Big companies seem to grab the best pieces before it’s too late, which is something you can see with developments like Terrafugia being acquired by Volvo-owner Geely, and Aurora Flight Sciences being acquired by Boeing. We’re also seeing some pivoting happening in this sector, as companies like Ehang have changed their strategy to move away from recreational drones to AAT’s.

- In the consumer/recreational market, drone racing events and selfie drones continue to define the space. Many have had to fight to stay relevant here, as Parrot’s struggles in the space directly led to the transition of Bebop for commercial purposes, Lily’s failure allowed the Mota Group to acquire the product and DreamQii had to issue refunds on account of their PlexiDrone.

Software:

- Powerful pieces of inspection software have been developed which utilize pattern recognition for asset management. The industrial needs to integrate AI & Deep Learning algorithms will allow these programs to automate inspection processes even more, and in turn, provide more value.

- Many strategic software partnerships have been formed to provide end-to-end solutions because many organizations have recognized that providing one piece of the puzzle is not enough.

- API’s and approaches that allow drone data to be integrated into existing processes quickly become a requirement. Opening channels (API) and tools that integrate drones into established processes came on in a big way in 2017, and that development will become even more distinct in 2018.

- Aerial Data Providers such as Airbus Aerial and Intel Insights have taken the concept of aerial acquired data to a new level. Providing a virtual data platform for satellite, plane and drone data unshackles them from drone operation and the corresponding risk.

- The UTM has unlocked many national and international partnerships, and we’ve started to see the results of these developments. Skyward and Airmap have become the first organization to be able to provide LAANC accreditation.

Service:

- There’s a lot of talk about drone logistics services, but we’ve finally seen an impact that has gone beyond marketing. Matternet and Zipline are just two of the companies that are frequently flying medical deliveries in Europe and Africa. Drone-based warehousing solutions are also on the rise.

- Drone show providers have showcased an entirely new application for the technology. Intel’s’ halftime-show and many other drone swarms have ushered in a new era of outdoor and indoor entertainment.

- System integrations that are being provided and created have taken on critical importance. More tailor-made solutions are required by various industries, and that means more providers are working to alter standard configurations to meet industry-specific needs

- Drone accelerators programs have uncovered the potential of the extremely quick-moving drone companies. They’ve jumped started new companies, and more of that will happen in 2018.

- Organizations that provide Drones as a Service (DaaS) have matured to the point that providers have proven they can contract big business. This service has also been augmented by certain jobs whose complexity has been reduced, meaning that the DaaS model can allow savings to stay in-house.

Counter-UAS:

- This is a new market in the civil world that’s rapidly growing with big funding and large international partnerships

- Pure CUAS conferences and expos have been created to explain threats and opportunities

- There are limitations for physical and non-physical systems that include jammer restrictions (federal network agency) and problems for health in public spaces (e.g. pacemakers).

Components and Systems:

- High priced equipment and flights in populated areas call for rigorous safety measures, which is why there’s been a proliferation of launch & recovery They provide more awareness and available solutions for operational security.

- Brand new drone propulsion methods have been developed, and they’re as essential as they are powerful. Hybrid systems (battery/fuel cell, gas/battery) allow long endurance/range by optimizing mission requirements for hardware.

- Cameras are now being used for indoor navigation while FLIR cameras almost sold out due to high demand from industry.

- Encrypted data links are getting very popular since the standard drone-to-ground communication is quite vulnerable. Data & communication logistics and details will continue to be a top priority.

- Drone ground stations, aka “drone box” solutions, have been labeled by some as complete solutions since they offer a roof over your drone and the ability to wirelessly charge/exchange batteries before the drone takes off on a new pre-programmed flight.

Drop-outs/Struggle:

- Crowdfunding does not seem to work, as we saw a lot of failures and bankruptcies. Those include Bionic Bird, Micro Drone, FlyPro, Lily, Onagofly and Globe Drone, among others.

- Many supplier/retailer vanished due to hard competition and not yet high demand, especially in Europe.

- Yuneec laid off 70% of its U.S. staff in March of 2017 and introduced a new CEO. Parrot announced in January 2017 that it was going to reduce its drone team from 840 employees to 290 people, which represents a reduction by about 66%. Autel also laid off employees in February 2017, while GoPro just announced they were entirely shutting down their drone division and laying off more than 200 employees. All of these developments are an indication of how untenable the aerial market is, and that’s mostly due to the dominance of DJI.

- While niches like drone racing and selfie-drones seem to work well for many startups, there’s a simple fact that’s impossible to get around: building hobby drones is hard. It’s going to get even more competitive now that DJI has announced ‘Tello’ – a $99 selfie drone designed by Ryze Tech.

Takeaways

- Machine learning for drone navigation and data analytics is driving numerous developments.

- The degree of automation and adoption of drone technology will further increase.

- Conglomerates will directly address the drone market. In the past startups, came up with niche solutions and sometimes were happy to partner with a big industry player, which is something that happened with Airware and Caterpillar. Now though, big companies like Komatsu & NVIDIA are partnering to bring solutions with a bigger scope to the market. Those are partnerships designed to sort out logistics related to topics like AI. It begs to question of whether we’ll see companies like IBM and Hitachi or Qualcomm and Mitsui form the next major partnership that will have a direct and indirect impact on the drone industry.

- There is a lot happening under the radar in China, especially in agriculture and delivery.

All of these developments are indicative of how and why 2018 is going to be so exciting. The drone industry as a whole will undoubtedly go through some exhilarating highs and discouraging lows. We’ll see solutions that are going to become mature and easier to integrate into existing workflows as well as new capabilities that will enable uses few have even considered. The Drone Ecosystem Map will be a critical resource you’ll be able to refer to and utilize throughout this process. To learn more about the players, their capabilities and their role in the market feel free to contact us. To learn more about the companies listed on the map, check out our services.

No matter if overhyped or not, a well-educated market is a stable market. That’s the kind of market we can all contribute to and want to be part of.

Have a great and successful year 2018!

Miriam McNabb is the Editor-in-Chief of DRONELIFE and CEO of JobForDrones, a professional drone services marketplace, and a fascinated observer of the emerging drone industry and the regulatory environment for drones. Miriam has penned over 3,000 articles focused on the commercial drone space and is an international speaker and recognized figure in the industry. Miriam has a degree from the University of Chicago and over 20 years of experience in high tech sales and marketing for new technologies.

For drone industry consulting or writing, Email Miriam.

TWITTER:@spaldingbarker

Subscribe to DroneLife here.