CB Insights has published their first ever Future of Tech Report research project looking at what is in store for the future of augmented and virtual reality, space and satellites, and drones.

You can view the full report right here and it is definitely worth your time if you are a future tech enthusiast, but some of the report’s findings about drones deserve to be called out and discussed.

Fast Facts

- Since 2014, drone companies have raised a total of $285 million in funding.

- Nearly half of that amount is from Q2 2015 which saw a $75 million Series B for DJI, a $14 million for 3D Robotics and a $5 million Series A for Squadrone System (makers of the HEXO+ follow me drone).

- Only 9 venture capital firms have made multiple investments in drone companies.

- The 6 companies with the most venture capital support are:

- 3D Robotics ($99 million)

- DJI ($75 million)

- Airware ($40.2 million)

- Skycatch ($21.4 million)

- Xaircraft ($20 million)

- CyPhy Works ($14.9 million)

Drone Investments

The apparent take-away from this last point is that hardware manufacturers are getting more support, as four of those six companies actually make drones while the other two are focused on software development (Airware) and enterprise services (Skycatch).

But the report goes on to say that the actual split in funding is pretty evenly split between hardware and software/services.

Of course, this takes into account private investments and crowd funding, which has proven to be a very successful avenue for aspiring drone companies.

This observation is also more inline with other industry predictions, including our own. Already, the software/services category has inched ahead of hardware and we expected this rift to continue to grow.

You can count the number of major PC or smartphone manufacturers on one (maybe two) hands. But new SaaS companies or app developers are making headlines every day. There is simply more demand, less competition and therefore more money in software and services because, for better or worse, the hardware guys have a firm grip on the market.

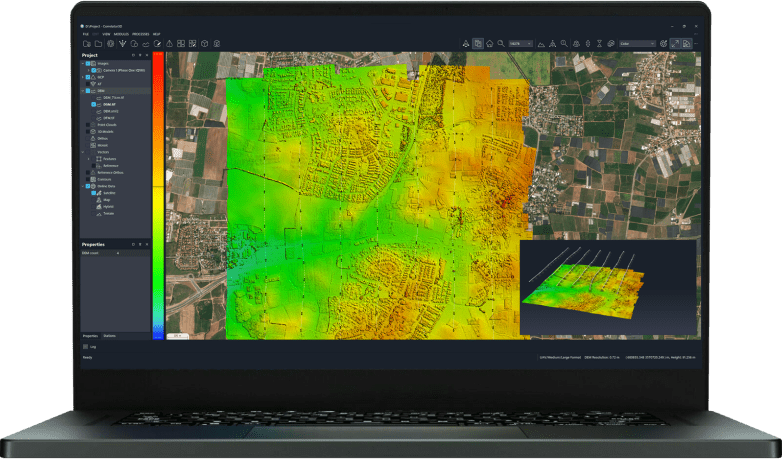

Drones are certain to follow this pattern; the hardware guys will maintain their grasp while new software companies will pop up regularly and invent new applications.

Of course, there is room for new hardware… when some company discovers a brand new use for drones, some company will set out to build a drone optimized for this use case, but it’s hard to predict when and how this will happen.

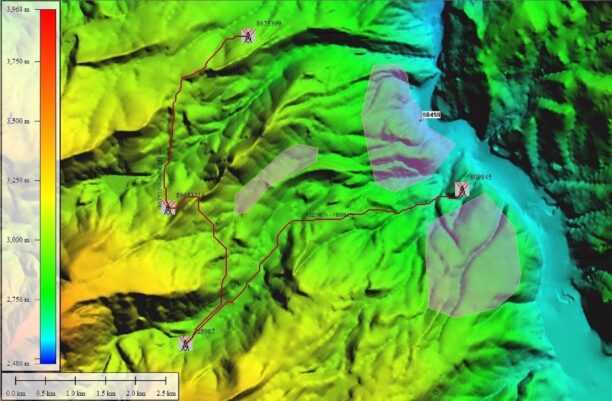

Chances are, the new drone will be built and optimized for one of CB Insights two most promising growth industries for drones: precision agriculture or delivery.

Drone Exemptions

The final major finding of the report is the division of Section 333 exemptions granted by the FAA to companies in various industries for federally sanctioned drone operations.

The report found that, as of July 2015, nearly half of the Section 333 exemptions granted by the FAA are for companies in the film/photography industry.

The next closest use case is inspection/monitoring at 26%.

Of course, this number is expected to rise -as is the amount of exemptions granted for mapping and precision agriculture- as the investments keep pouring in and drone technology gets more sophisticated.

Again, you can get your hands on the full report right here.

Alan is serial entrepreneur, active angel investor, and a drone enthusiast. He co-founded DRONELIFE.com to address the emerging commercial market for drones and drone technology. Prior to DRONELIFE.com, Alan co-founded Where.com, ThinkingScreen Media, and Nurse.com. Recently, Alan has co-founded Crowditz.com, a leader in Equity Crowdfunding Data, Analytics, and Insights. Alan can be reached at alan(at)dronelife.com

Leave a Reply