Last week, we reported on the Robotics and Drone Index, a benchmark index compiled for UBS by Solactive AG to track companies that develop automated robotics as well as drone solutions. This week it’s the introduction of Drone.VC, a syndicated drone venture fund led by entrepreneur David Weekly (founder of Hacker Dojo).

Under the Angelist umbrella, the fund will be specific to investments in the commercial drone space. Investments are intended to be the first money in to early stage drone prototype-phase companies. The fund will not make investments in military-focused or weaponized platform companies.

Weekly got the drone bug when he flew his first autonomous mission with his 3DRobotics IRIS quadcopter. Weekly told TechCrunch, “I had noticed a number of my friends starting to tinker with drones in the past few months – actually a lot of people who were web 2.0 entrepreneurs have gotten drones and started playing with them, so I was curious what all the fuss was all about …The hairs on my arms tingled when we sent the drone on its first fully autonomous mission. Watching this thing I had just wirelessly commanded take off and perform a mission while streaming real time telemetry to my laptop was really a 21st century moment, like seeing a self-driving car on the freeway.”

As of today, the fund has commitments of $55,000, from a list of successful entrepreneurs including John Hering, Founder and Chairman of Lookout and Brian Krausz, Cofounder of Gazehawk. The fund is open to accredited investors.

But is the time right for a drone-focused venture fund?

Timing is everything in investing. The average time from a venture financing to an M&A (merger and acquisition) exit has been increasing and now averages over eight years. During those eight years, three things need to happen for a big payday: 1) The start-up company needs to perform and show that they have a product or service with a unique selling proposition; 2) The company needs continued support from the venture community, as early revenues will unlikely cover the burn; and 3) The company needs the stars to align just right so as to shine brightly on their industry.

It’s likely that there will be many innovative hardware, software, and service companies addressing the horizontal and vertical opportunities of the drone market. It will be an exciting time for entrepreneurs looking to apply drone technology to delivery services and hundreds of other opportunities.

Subsequently, VCs will follow with their dollars! They are always looking for the next big industry and are willing to make many bets, many times, to find success and show leadership.

When will the drone space be real?

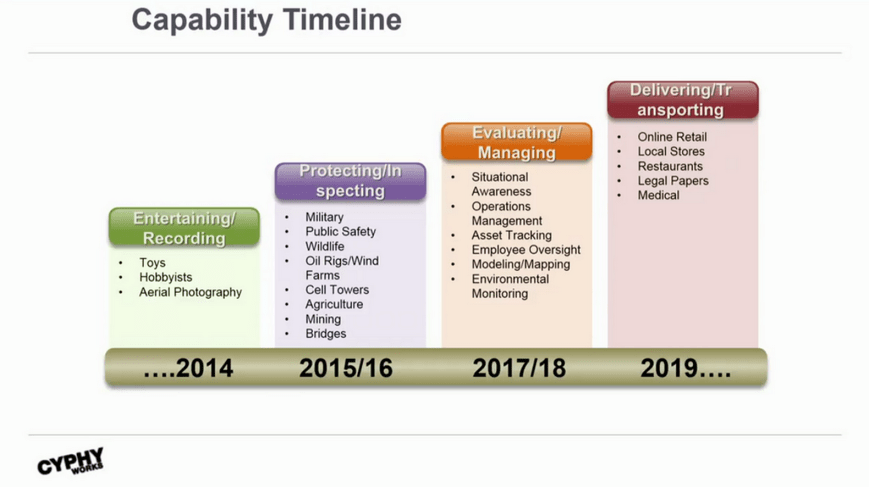

Helen Greiner, co-founder of iRobot and now co-founder and CEO of drone company CyPhy Works presented her market outlook a few months back at DEMO. In her presentation, Greiner predicted the evolution of the non-military drone industry over the next five years -from mere enthusiasts in 2014 to delivery drones in 2019 and beyond. The chart below lays out her vision of how the industry will evolve.

So if you believe Helen, the timing looks to be pretty great. Today’s investments will provide a fleet of mature, exciting drone companies in the early 20’s (yes, that’s 2020’s) right when the dramatic shift of drone market enthusiasm and adoption (the hockey stick chart) takes place. What follows then: M&A activity!

Are you ready to place your bet? Let us help you find a drone company you can get behind >>>

Alan is serial entrepreneur, active angel investor, and a drone enthusiast. He co-founded DRONELIFE.com to address the emerging commercial market for drones and drone technology. Prior to DRONELIFE.com, Alan co-founded Where.com, ThinkingScreen Media, and Nurse.com. Recently, Alan has co-founded Crowditz.com, a leader in Equity Crowdfunding Data, Analytics, and Insights. Alan can be reached at alan(at)dronelife.com

Leave a Reply