Guest post by Kay Wackwitz, Drone Industry Insights —

Although the commercial unmanned aviation industry is still in its infant days, the market already presented a diverse range of fantastic hardware, software and operational products. These prerequisites connected, especially in the last two years’, many accelerator, early stage and also later stage investment companies with the market. The investors strongly raised their portfolio by UAV companies, which led to the record-breaking funding year 2015 for the commercial UAV market.

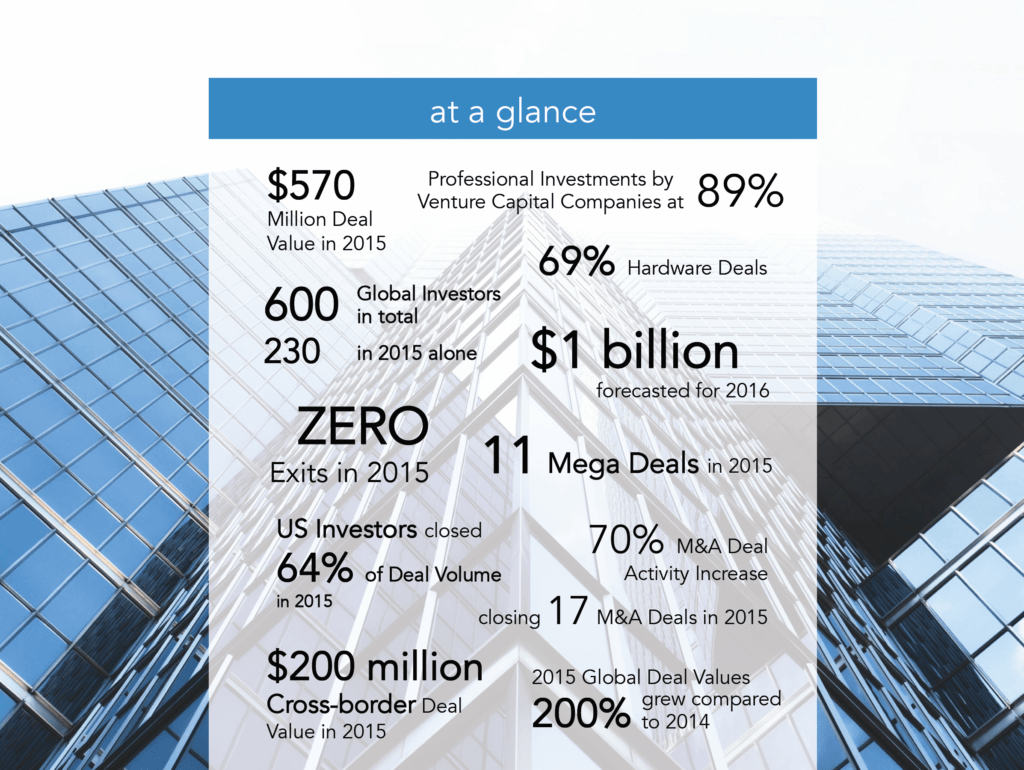

Here some facts from the Droneii.com Investment report 2016:

(Click on the image for a larger version. Click “Back button” to return to story.)

The combination of an increasing investment trend and high technology lead to a successful market entry of the strong and new commercial UAV business.

To enable an outlook of deal value and deal volume Droneii.com provides five key trends for commercial UAV investments:

1. Investment strategy trends:

High risk or early stage venture deals are still in high demand in the new commercial UAV market. 68% of all deals since 2006 were located in Angel, Seed, Accelerator/Incubator, Product Crowdfunding and Early VC investments stages. In 2015 the share increased to 70%, which means the race for the most profitable exits still has just begun.

After the regulatory process is set-up, high acceleration of Mergers & Acquisition activities is expected, which also means that the M&A strategy will change: Enterprises acquisition activities with the goal of integration increase their market investments and slowly supersede the Exit-oriented capital firms.

2. Political and economic trends:

The Economic climate can be described as careful, but strong enough for an investment increase, the financial policy fosters non-monetary investments as never before, so that the specific UAV regulation situation is the strongest restraint for investments.

3. UAV Market and Sector trends:

While the big consumer oriented Hardware companies have already received the biggest lump of deals, we can expect an orientation change to the services and software Sector. Services of and by UAVs will have a big influence on the industrial market and is going to supersede traditional ways in the next five to ten years. Cost-saving and occupational health aspects accelerate this industrial revolution. Speed and Quality of data transfer and analysis are the crucial factor for the Services sector and challenge the software Sector to provide the fastest and most reliable solutions. Software investments still focus on Mapping & Navigation (Airmap, Dronedeploy, PreNAv) and Flight Management (Airware). The trend will move to BVLOS and delivery software.

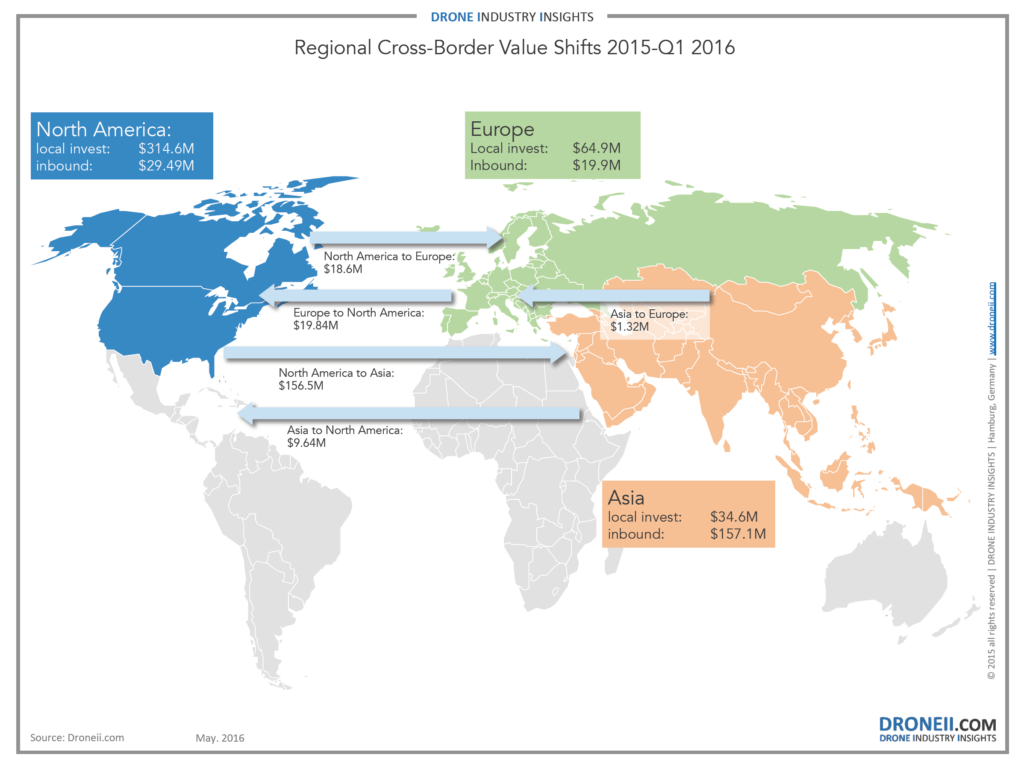

4. Regional investments:

The regional investments swap slowly from Silicon Valley and China to Europe. France and UK have a very good basis of a regulatory framework and benefit from operation experience and regions high technology, which makes investments very promising.

(Click on the image for a larger version. Click “Back button” to return to story.)

The Cross-border deal flow is expected to be an important theme in the coming years, as major economies strike agreements and alliances. TPP – USA and Pacific States and TIPP – USA and EU can be agreed soon.

5. UAV applications:

The recent investment deals are application-independent. The products of the Hardware driven investment market is mainly adaptive for a wide range of applications.

Since the sector orientation just began to change the direction to services and software companies, the application itself became more and more important. While the aerial photography and filming application was on his investment peak (DJI, Yuneec, Ehang), the run for 3D imagery/photogrammetry (Spotscale and others) and Agriculture (PrecisionHawk and many others) investments started through last year. The recent investment deals and market data show the trend to the industrial application market: Aerial wind, oil, gas and solar inspection (Sky-Futures, Sharper shape) will become an industrial standard soon. Transportation and Delivery (Medical, Food), the most expected and media-loved application, still needs to overcome some technical and regulative obstacles before a high demand for investments will be developed.

In case you have missed one of our last articles:

Frank Schroth is editor in chief of DroneLife, the authoritative source for news and analysis on the drone industry: it’s people, products, trends, and events.

Email Frank

TWITTER:@fschroth

It’s appropriate time to make some plans for the long run and it is time to be happy.

I’ve read this put up and if I may just I want to suggest you some attention-grabbing issues or tips.

Perhaps you can write subsequent articles regarding this article.

I want to read even more issues approximately it!