The drone industry is big news these days – and one drone industry forecast after another is released hyping the seemingly unlimited potential for the market. But that was not always the case: a review of market reports released over the past few short years makes it abundantly clear that the explosive growth of the civilian drone market took analysts totally by surprise, and leaves the future of the market anyone’s guess.

Dollar value estimates of “the drone market” vary widely, and much depends upon what analysts choose to measure. Some experts have focused on the potential value and sales of the drones themselves; others have speculated on the value of commercial applications. Apples-to-apples comparisons and real data sources are hard to find, but a look at 2020 predictions in reports published by the same agencies a few years apart shows the tremendous difference in the way that industry estimates have changed over a short time period.

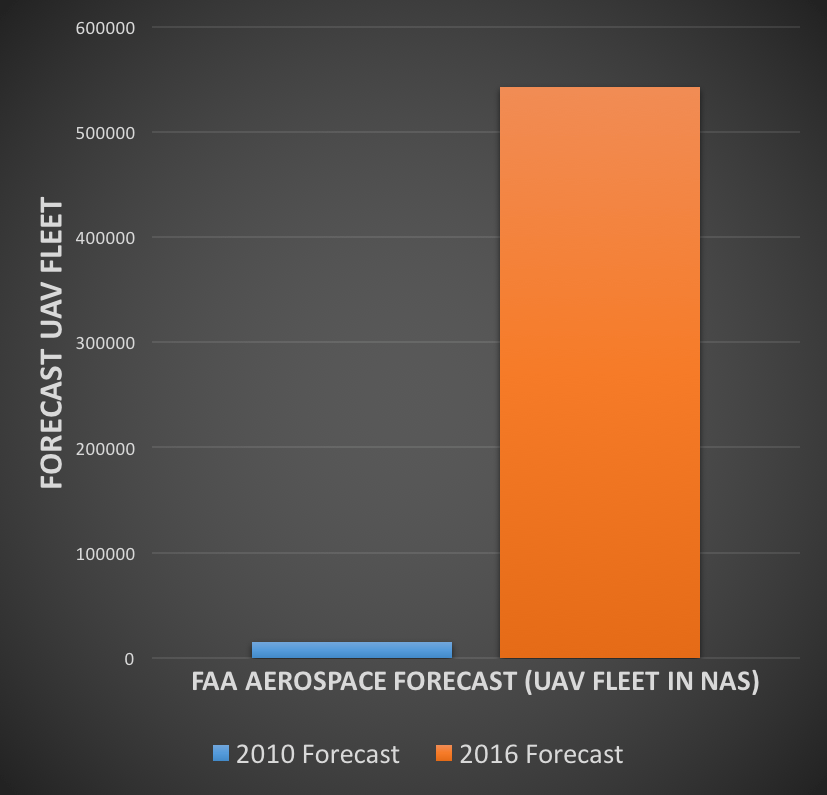

In 2010, the FAA’s Aerospace Forecast for the years 2010 – 2030 outlined a UAV forecast estimating the number of drones likely to be in civilian hands in 2020: 15,000 units. The estimate was wildly wrong, but the FAA did get some points right; and a reminder of the expert thinking back in 2010 offers some insight into why the FAA has been so slow to ramp up commercial drone integration into the NAS:

In 2010, the FAA’s Aerospace Forecast for the years 2010 – 2030 outlined a UAV forecast estimating the number of drones likely to be in civilian hands in 2020: 15,000 units. The estimate was wildly wrong, but the FAA did get some points right; and a reminder of the expert thinking back in 2010 offers some insight into why the FAA has been so slow to ramp up commercial drone integration into the NAS:

Because the industry is in its infancy, forecasts of the number of units are relatively few and have considerable variation. Recent work by RTCA, Inc., has identified the drivers and impediments to future growth in the aforementioned three market segments and has included forecasts of the number of UAS units by market segment. The forecasts generally assumed that 1)commercial activities would not begin until 2018; 2) no significant technological or extraordinary demand would accelerate the introduction of UAS’s; 3) costs of UAS systems would decline as the technology matures and as the scale of operations increases.

Obviously, from a 2016 perspective “commercial activities” are well underway, and significant technology changes have indeed accelerated the demand for drones. Prices have declined, scale has increased, and the UAV predictions for 2020 in the 2016 FAA Aerospace Forecast look a lot different. This time, the prediction of the number of drones likely to be in civilian hands by 2020 is a whopping 542,500.

In the newest report the FAA hedged their bets, saying:

The number of small UAS forecasted is highly uncertain and is dependent on the regulatory structure ultimately adopted. Once a final rule for small UAS is published, they will become more commercially viable than they are today.

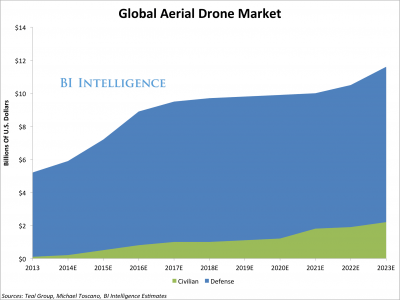

The FAA wasn’t the only agency to guess wrong on the growth of the drone industry. In 2014, Business Insider published a drone report that estimated the Global Aerial Civilian Drone Market in 2020 at about $1 billion. A little less than two years later, a new Business Insider Drone Report estimates Enterprise Drone Shipments alone to top $12 billion by 2021, saying that while technological barriers may still limit adoption, they can see the pace increasing:

The FAA wasn’t the only agency to guess wrong on the growth of the drone industry. In 2014, Business Insider published a drone report that estimated the Global Aerial Civilian Drone Market in 2020 at about $1 billion. A little less than two years later, a new Business Insider Drone Report estimates Enterprise Drone Shipments alone to top $12 billion by 2021, saying that while technological barriers may still limit adoption, they can see the pace increasing:

The accelerating pace of drone adoption is also pushing governments to create new regulations that balance safety and innovation. The FAA is set to release new regulations this spring could help boost adoption. Safer technology and better regulation will open up new applications for drones in the commercial sector, including drone delivery programs like Amazon’s Prime Air and Google’s Project Wing initiatives.

Even in short time frames, the estimates have exploded. Research firm Marketstomarkets published a small UAV forecast in December of 2014 projecting $1.9 billion by 2020. Fourteen months later the same firm’s small UAV market forecast puts the estimate up over $10 billion, saying:

The increasing demand for commercial application is expected to drive the growth of the small drones market during the forecast period of 2015 to 2020. The advancements in payloads technology over the past decade have led to an increased use of small drones for a variety of operations and tasks, in the defense as well as commercial sector. The rising need for advanced, efficient, and reliable small drones, and the trend of military modernization across these nations are expected to drive the overall market growth.

While the universal shift upwards in estimates for the drone industry seems obvious in retrospect, the fact is that experts across the board have dramatically underestimated the economic impact of drones. The real question at this point is whether or not they have finally gotten a handle on the industry’s trajectory, or if next year’s estimates for 2020 will again show exponential growth as drone technology continues to surprise us.

Miriam McNabb is the Editor-in-Chief of DRONELIFE and CEO of JobForDrones, a professional drone services marketplace, and a fascinated observer of the emerging drone industry and the regulatory environment for drones. Miriam has penned over 3,000 articles focused on the commercial drone space and is an international speaker and recognized figure in the industry. Miriam has a degree from the University of Chicago and over 20 years of experience in high tech sales and marketing for new technologies.

For drone industry consulting or writing, Email Miriam.

TWITTER:@spaldingbarker

Subscribe to DroneLife here.

[…] Drone Life: https://dronelife.com/2016/04/08/comparing-drone-industry-forecasts/ […]