Reality Shares, a San Diego- based asset management firm, ETF issuer, and index provider has created the first DRONE STOCK INDEX.

An index is a statistical measure of the changes in a portfolio of stocks representing a portion of the overall market. Investors use indexes to track the performance of a portion of the stock market. Ideally, a change in the price of an index represents an exactly proportional change in the stocks included in the index. Index exchange-traded funds (ETFs) are designed to track these representative portfolios while offering generally lower fees and more seamless intraday trading. The Reality Shares Drone Index was developed to provide a benchmark for investors interested in tracking companies actively involved in drone technology and services. The Index allows investors to quickly take advantage of both event-driven news and long-term economic trends as the market for drone technology continues to evolve. Companies in the index are grouped into two tiers — Primary and Secondary — based on their involvement in and contribution to the drone industry. The overall weights for each category are capped based on the drone component in their business model. Within each category, the Index component weights are determined by the Index Committee, based on their Drone Score™. Index constituents are reviewed semi-annually (in June and December) for eligibility, and the weights are reset accordingly. The Reality Shares Drone Index includes many foreign-domiciled corporations, and companies must have a minimum market capitalization of $100 million to be eligible for inclusion in the Index.

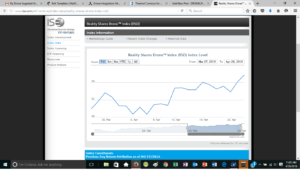

Over the coming week, DroneLife will drill down and present some of the companies included in the Index. You can follow the index here.

Alan is serial entrepreneur, active angel investor, and a drone enthusiast. He co-founded DRONELIFE.com to address the emerging commercial market for drones and drone technology. Prior to DRONELIFE.com, Alan co-founded Where.com, ThinkingScreen Media, and Nurse.com. Recently, Alan has co-founded Crowditz.com, a leader in Equity Crowdfunding Data, Analytics, and Insights. Alan can be reached at alan(at)dronelife.com