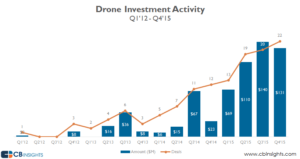

Drone Startups raised over $450million in 2015, investment research firm CB Insights reports. While the number represents a 300% increase over dollars invested in 2014, the increase in deals is much smaller, with the number of firms funded demonstrating a 111% increase over last year.

FAA exemptions for commercial operators picked up the pace this year, allowing more drone companies to enter the field. Still, uncertainty over future regulations may be limiting some investment. Take as an example two companies who offer agricultural monitoring tools: one asks the users to fly their own drone over their property and upload footage, another provides licensed pilots and proprietary drones to take the footage. While both companies provide a similar service, the marketplace winner could be chosen not by the consumer but by the FAA when they decide whether or not commercial drones must be operated by licensed and registered pilots.

Some investors, at least, seem willing to take the chance on emerging drone technologies. Drone sector investments hit a record high on a dollar basis in the third quarter, reaching $140M, but as the headlines touted millions of drones sold for Christmas, the sector saw a flurry of smaller deals in the fourth quarter.

Already established firms received the largest funding packages – the report states that there were 11 equity financing packages of over $10m in 2015; including some very large deals to the already established market leaders in drone manufacturing: DJI Innovations ($75M Series B), YUNEEC ($60M Venture Capital), and 3D Robotics ($50M Series C).

While Q4 investment totaled $131million, that figure includes $45.9million to Aeryon Labs and $22million in Series B funding to CyPhy Works. The remaining funding – approximately $63million – was divided amongst 20 other companies.

There is no doubt that all of this early stage funding looks good for the drone industry: 67% of all equity deals in 2015 came at the early-stage (Angel – Series A). New companies forming can only boost the development cycle of drone technology and offer new product innovation. Hopefully the FAA will be able to keep up with the demand by allowing new commercial enterprises to form.

Miriam McNabb is the Editor-in-Chief of DRONELIFE and CEO of JobForDrones, a professional drone services marketplace, and a fascinated observer of the emerging drone industry and the regulatory environment for drones. Miriam has penned over 3,000 articles focused on the commercial drone space and is an international speaker and recognized figure in the industry. Miriam has a degree from the University of Chicago and over 20 years of experience in high tech sales and marketing for new technologies.

For drone industry consulting or writing, Email Miriam.

TWITTER:@spaldingbarker

Subscribe to DroneLife here.