This latest round is funded by a diverse group of venture and strategic investors. CEO Michael Chasen says that all of the company’s previous investors came back, and new investors were added – including one of PrecisionHawk’s clients. “This investment brings PrecisionHawk’s total funding to more than $100 million since being founded in 2010, making it the world’s most well-capitalized commercial drone company,” says the company press release. That means that this round of funding – big by any standard – is triple the size of previous investment.

It’s a big win for PrecisionHawk, already an industry leader: and for CEO Michael Chasen, who’s been leading the company for only a year. But it’s good news for the entire industry also, providing validation that the investment community sees the enterprise drone industry as a viable and growing sector. With this round, the drone industry has traveled the road from Angel investors to smaller VC funded rounds to major capital injections – like this one – by groups including Comcast Ventures, Verizon Ventures, Intel Capital and DuPont.

“I think we all saw funding wane across the commercial drone industry after running into regulatory roadblocks and inability to prove immediate enterprise value. We believe this $75M is a peg that validates an overall upwards trajectory,” says Lia Reich, PrecisionHawk’s VP of Marketing and Communications.

CEO Michael Chasen says that the time is right for the enterprise drone industry. While the company has been in existence since 2010, Chasen says that their sales pipeline “exploded” after Part 107 regulations were put in place, the result of pent up demand. “People were waiting to see how that regulation affected thing,” says Chasen. “Now we see that companies are lining up to use this technology.”

The company’s longevity in the space has given them time to develop deep expertise and deep solutions. “There are three factors that really differentiate us,” says Chasen. “We’ve been around the longest, we have the most experience of anyone else in the industry. We’re one of the only companies that can fly BVLOS. And we have some of the best technology out there – we partner with drone manufacturers, but we have some of the best software in the industry. Our clients are getting the best results.”

Their investors evidently agree.

“We see the potential for PrecisionHawk to enable enterprises around the world with new tools for 21st century opportunities,” said Robert Schwartz, Managing Partner of Third Point Ventures. “We believe the business insight that can be achieved with PrecisionHawk technology will be a catalyst for profound transformation, and this investment gives us an opportunity to support their growth and continued industry leadership.”

“Syngenta has been a PrecisionHawk customer since 2015 and has experienced first-hand the impact of the technology platform; both augmenting and replacing a variety of manual processes for more efficient and scalable operations” said Katrin Burt, Managing Director of Syngenta’s venture capital group. “This investment reflects our commitment to advancing technologies that could have a real impact within agriculture and our excitement about the potential for PrecisionHawk to lead the commercial drone space across multiple industries.”

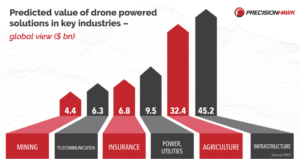

PrecisionHawk has grown fast in the last 12 months. The company hired over 100 new employees in 2017 and expanded into new industries, adding product offerings in energy, insurance, government and construction to their existing strong stake in the agriculture sector. But Chasen says that PrecisionHawk is playing the long game for a big goal. “As a company, we’re focused on the long term. We’re putting together a strategy that’s 3 – 5 years at a minimum – but we’re aiming for a global leadership position in the drone industry,” Chasen says.

That strategy includes new investments in solutions. PrecisionHawk plans to put more resources towards automation software and deep analytics for the industries they serve. They will focus on building out technology that will help more companies fly beyond visual line of sight (BVLOS) which Chasen says represents a big step for the industry. The first commercial company in the country with a BVLOS waiver, “We’ve become experts in this,” says Chasen. “Once drones fly that [BVLOS] distance, you’ll see some really interesting applications open up.”

With new products in the works and some possible mergers and acquisitions, the new capital will certainly give PrecisionHawk a major growth advantage. If this is the first wave in the rising tide of investment in drone technology, the entire industry may lift in the coming year.

Miriam McNabb is the Editor-in-Chief of DRONELIFE and CEO of JobForDrones, a professional drone services marketplace, and a fascinated observer of the emerging drone industry and the regulatory environment for drones. Miriam has penned over 3,000 articles focused on the commercial drone space and is an international speaker and recognized figure in the industry. Miriam has a degree from the University of Chicago and over 20 years of experience in high tech sales and marketing for new technologies.

For drone industry consulting or writing, Email Miriam.

TWITTER:@spaldingbarker

Subscribe to DroneLife here.